Annual Meeting of Stockholders

2025 Annual Meeting of Stockholders

May 21, 2025 - 9:00 AM MDT

Related Materials

Letter to the Stockholders

Dear Fellow Stockholders:

The Joint provides access to many with affordable, concierge-style, membership-based services in convenient retail settings. I joined the company in October 2024, because The Joint is a highly differentiated scale player with a strong core and significant opportunities. My goal is to activate our talented leadership team to leverage our advantages to become a world class, pure play franchisor. We are implementing initiatives to improve our clinic economics and company profitability, increase clinic count, and create stockholder value. Before I unveil our new strategic plan, let’s review our financial and operating highlights for 2024, compared to 2023.

2024 Performance Highlights

Our financial and operating highlights for 2024, compared to 2023 were as follows:

|

14.7 million

PATIENT VISITS, UP FROM 13.6 MILLION

|

1.9 million

UNIQUE PATIENTS, UP FROM 1.7 MILLION

|

957,000

NEW PATIENTS, UP FROM 932,000

|

||||||||||||

|

36%

OF NEW PATIENTS HAD NEVER VISITED A CHIROPRACTOR BEFORE THE JOINT, CONSISTENT WITH THE PRIOR YEAR

|

85%

OF SYSTEM-WIDE GROSS SALES FROM MEMBERSHIPS, ALSO CONSISTENT WITH THE PRIOR YEAR

|

10%

INCREASE IN REVENUE FROM CONTINUING OPERATIONS TO $51.9 MILLION FROM $47.0 MILLION1

|

||||||||||||

|

9%

INCREASE IN SYSTEM-WIDE SALES2 GREW TO $530.3 MILLION

|

$1.5 million

NET LOSS FROM CONTINUING OPERATIONS, COMPARED TO $10.8 MILLION NET LOSS FROM CONTINUING OPERATIONS

|

$2.7 million

IN ADJUSTED EBITDA FROM CONTINUING OPERATIONS, COMPARED TO $4.5 MILLION

|

||||||||||||

- At year-end, we recorded the corporate-owned or managed clinics as discontinued operation for 2024 and recast 2023 for an apples-to-apples comparison. In 2024, this recognition eliminated the $70.2 million in associated revenue, $66.5 million in associated SG&A, and $10.4 million in associated impairment and a net loss for discontinued operations of $7.0 million.

- System-wide sales include revenues at all clinics, whether operated or managed by the company or by franchisees. While franchised sales are not recorded as revenues by the company, management believes the information is important in understanding the company’s financial performance because these revenues are the basis on which the company calculates and records royalty fees and are indicative of the financial health of the franchisee base.

In addition, The Joint is frequently recognized for our excellence. For instance, in 2024, SUCCESS named us as one of the “Top 50 Franchises” and Franchise Times recognized The Joint as No. 38 on the Fast & Serious and ranked No. 150 of annual “Top 400.” In addition, in early 2025, Entrepreneur Magazine’s named The Joint the top franchise in chiropractic services and No. 54 on Franchise 500, jumping 29 spots since last year.

While we continued to improve KPIs and grow the business and we are proud of our accolades, I see areas for improvement to strengthen our position as the leading chiropractic care provider, become a pure play franchisor, grow sales, reduce overhead and improve profitability.

Focused on Becoming a World Class, Pure Play Franchisor

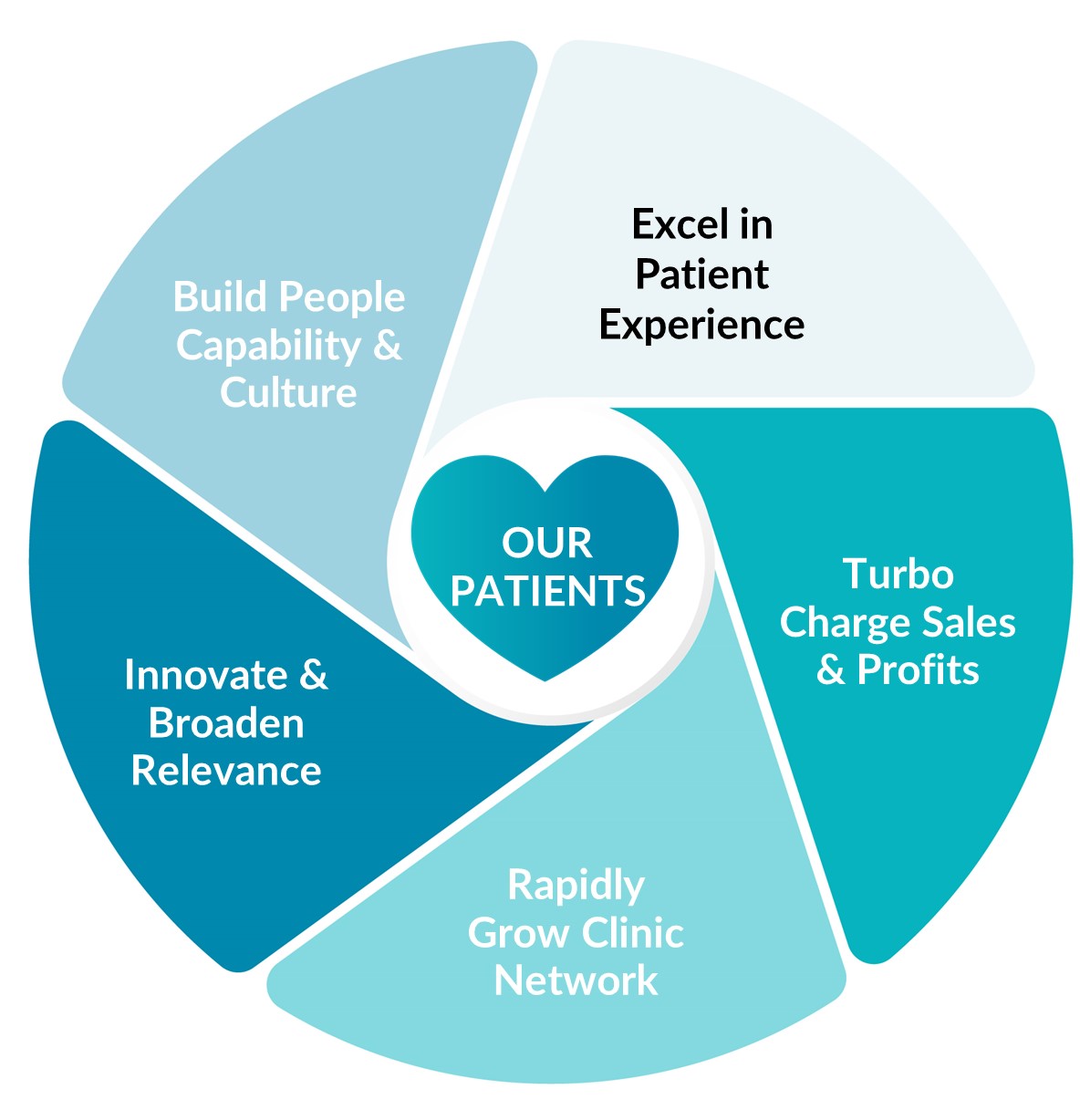

My team and I performed an extensive 100 days analysis of The Joint, the chiropractic care and adjacent industries yielding actionable data. Each of our strategic priorities fosters the next, creating a flywheel. After placing patients at the heart of everything we do, we have begun to do the following:

- Build our people capability and culture to support our clinics, nurture talent, strengthen engagement, and attract and retain the best Doctors of Chiropractic. This will enable us to

- Excel in patient experience. By optimizing care delivery and patient touchpoints, we will fuel our most effective and cost-efficient patient acquisition tool – referrals – as well as

- Turbo charge sales and profits for both our franchisees and the company. By bolstering our foundation, refranchising and reducing unallocated overhead expenses, we will improve the bottom line, which will

- Reignite clinic network growth.By updating our key development processes to ensure stronger new clinic performance, we will drive sustainable new clinic growth in the large white space we have. Simultaneously, we will also

- Innovate and broaden our relevance. We will refresh our brand communications and brand architecture, start to re-platform the tech stack and explore new chargeable options for patient clinical care.

These key priorities set the foundation of our strategic growth plan.

Unveiling The Joint’s Multi-year Phased Approach for Growth

In our next phase, or The Joint 2.0, we will strengthen our core, reignite growth, and improve clinic and company level profitability. As we refranchise our corporate clinics and shift to a pure franchise concept, The Joint as a company will benefit economically. We will no longer carry the costs of operating clinics, reducing overhead and increasing operating leverage. Refranchising will increase our capital. We will evaluate measures to improve our profitability profile, like acquiring regional developer territories, and/or return value to stockholders, like a stock repurchase program.

To drive revenue growth, we will initiate dynamic revenue management, strengthen our digital marketing and promotional calendar, and upgrade our patient facing technology. In addition, we will begin building infrastructure, test and validate elements of other revenue drivers that will shape our next phase.

In The Joint 3.0, we will capture new revenue streams by creating additional sales channels and growing in new markets. We will evaluate various alternatives, including:

- Expanding into systemwide enterprise or business accounts, building a B2B business to complement our B2C business;

- Building a tech differentiated competitive moat;

- Unlocking dense urban markets;

- Monetizing new clinical service(s) and chiropractic usage occasions; and

- Exploring opportunities to sell retail products in our clinics.

Our new strategic plan to strengthen our core and reignite our growth leverages our advantages to capture opportunities.

The Joint’s Advantages Create Opportunity

The Joint’s attractive asset-light, recurring revenue model attracts franchisees. In 2024, 85% of our revenue was contributed by memberships. Regarding clinic, or storefront, buildouts, The Joint has one of the lowest initial costs among health and wellness concepts, compared to Pilates studios, saunas, gyms and so on. At the end of December 31, 2024, we had over 960 clinics, making The Joint larger than our next 10 competitors combined and the clear category leader. This scale, combined with our first mover advantage and premier nationwide brand, has increased brand awareness and easy consumer access. Yet we have only scratched the surface and significant market opportunity remains available for growth. In the US alone, based on our current programming, when we conduct a bottom-up analysis, we have identified ideal locations with complementary demographics for approximately another 1,000 clinics – basically, we are only 50% of the way there. And when we review from the top down, we know the annual spending on chiropractic care is estimated to be $20.6 billion annually with out-of-pocket spend ranging from 37% to 42% of that total. As The Joint’s 2024 gross system sales of $530.5 million, representing between 6% and 7% of that out-of-pocket spend. And now, in 2025, we have a new detailed strategic plan to strengthen our core and reignite growth. We are committed to driving success, which we will define as growth in net new clinic openings, system-wide sales, comp sales and Adjusted EBITDA.

Emphasizing our Commitment to Patients and Stakeholders

Stockholders, we realize you have a lot of choices when choosing where to invest. We appreciate your trust in The Joint.

As noted earlier, we have placed patients at the heart of everything we do, which aligns perfectly with The Joint’s mission to improve the quality of life through routine and affordable chiropractic care. Upon evaluating our solid foundation and numerous opportunities, my team and I are augmenting The Joint’s vision: To become America's most accessible health and wellness services company.

This proxy statement and accompanying materials are first being made available to stockholders on or about April 8, 2025. The proxy materials include instructions on how to vote online, by phone, and by mail. Your vote is important regardless of the number of shares you own. Whether or not you plan to attend the 2025 Annual Meeting, we encourage you to consider the matters presented in the proxy statement and vote as soon as possible. We hope that you will be able to join us on May 21st. Thank you for your ownership and support of The Joint Corp.

Sanjiv Razdan

President and Chief Executive Officer