00016126302022FYfalseP3YP3YP1YP2Y11111P4YP2YP2YP2YP6YP8YP3YP4YP5Y00016126302022-01-012022-12-3100016126302022-06-30iso4217:USD00016126302023-03-01xbrli:shares00016126302022-12-3100016126302021-12-310001612630us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001612630us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-31iso4217:USDxbrli:shares0001612630jynt:RevenuesAndManagementFeesFromCompanyClinicsMember2022-01-012022-12-310001612630jynt:RevenuesAndManagementFeesFromCompanyClinicsMember2021-01-012021-12-310001612630us-gaap:RoyaltyMember2022-01-012022-12-310001612630us-gaap:RoyaltyMember2021-01-012021-12-310001612630us-gaap:FranchiseMember2022-01-012022-12-310001612630us-gaap:FranchiseMember2021-01-012021-12-310001612630us-gaap:AdvertisingMember2022-01-012022-12-310001612630us-gaap:AdvertisingMember2021-01-012021-12-310001612630us-gaap:TechnologyServiceMember2022-01-012022-12-310001612630us-gaap:TechnologyServiceMember2021-01-012021-12-310001612630us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001612630us-gaap:ProductAndServiceOtherMember2021-01-012021-12-3100016126302021-01-012021-12-310001612630us-gaap:CommonStockMember2020-12-310001612630us-gaap:AdditionalPaidInCapitalMember2020-12-310001612630us-gaap:TreasuryStockCommonMember2020-12-310001612630us-gaap:RetainedEarningsMember2020-12-310001612630us-gaap:ParentMember2020-12-310001612630us-gaap:NoncontrollingInterestMember2020-12-3100016126302020-12-310001612630us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001612630us-gaap:ParentMember2021-01-012021-12-310001612630us-gaap:CommonStockMember2021-01-012021-12-310001612630us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001612630us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001612630us-gaap:RetainedEarningsMember2021-01-012021-12-310001612630us-gaap:CommonStockMember2021-12-310001612630us-gaap:AdditionalPaidInCapitalMember2021-12-310001612630us-gaap:TreasuryStockCommonMember2021-12-310001612630us-gaap:RetainedEarningsMember2021-12-310001612630us-gaap:ParentMember2021-12-310001612630us-gaap:NoncontrollingInterestMember2021-12-310001612630us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001612630us-gaap:ParentMember2022-01-012022-12-310001612630us-gaap:CommonStockMember2022-01-012022-12-310001612630us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001612630us-gaap:RetainedEarningsMember2022-01-012022-12-310001612630us-gaap:CommonStockMember2022-12-310001612630us-gaap:AdditionalPaidInCapitalMember2022-12-310001612630us-gaap:TreasuryStockCommonMember2022-12-310001612630us-gaap:RetainedEarningsMember2022-12-310001612630us-gaap:ParentMember2022-12-310001612630us-gaap:NoncontrollingInterestMember2022-12-310001612630jynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMember2022-01-012022-12-310001612630jynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMember2021-01-012021-12-310001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-01-012022-12-310001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2021-01-012021-12-310001612630jynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-01-012022-12-310001612630jynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2021-01-012021-12-310001612630jynt:PurchaseOfPropertyPlantAndEquipmentIncludedInAccountsPayableMember2022-01-012022-12-310001612630jynt:PurchaseOfPropertyPlantAndEquipmentIncludedInAccruedExpensesMember2022-01-012022-12-310001612630jynt:PurchaseOfPropertyPlantAndEquipmentIncludedInAccountsPayableMember2021-01-012021-12-310001612630jynt:PurchaseOfPropertyPlantAndEquipmentIncludedInAccruedExpensesMember2021-01-012021-12-310001612630jynt:AssetsAndFranchiseAgreementMember2022-12-310001612630jynt:AssetsAndFranchiseAgreementMember2021-12-310001612630us-gaap:FranchisedUnitsMember2021-12-31jynt:clinic0001612630us-gaap:FranchisedUnitsMember2020-12-310001612630us-gaap:FranchisedUnitsMember2022-01-012022-12-310001612630us-gaap:FranchisedUnitsMember2021-01-012021-12-310001612630us-gaap:FranchisedUnitsMember2022-12-310001612630us-gaap:EntityOperatedUnitsMember2021-12-310001612630us-gaap:EntityOperatedUnitsMember2020-12-310001612630us-gaap:EntityOperatedUnitsMember2022-01-012022-12-310001612630us-gaap:EntityOperatedUnitsMember2021-01-012021-12-310001612630us-gaap:EntityOperatedUnitsMember2022-12-31jynt:corporation0001612630stpr:NC2022-12-310001612630us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-310001612630us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-12-310001612630srt:MinimumMember2022-01-012022-12-310001612630srt:MaximumMember2022-01-012022-12-310001612630us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MinimumMember2022-01-012022-12-310001612630us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2022-01-012022-12-31jynt:option0001612630us-gaap:FranchiseRightsMembersrt:MinimumMember2022-01-012022-12-310001612630us-gaap:FranchiseRightsMembersrt:MaximumMember2022-01-012022-12-310001612630us-gaap:CustomerRelationshipsMembersrt:MinimumMember2022-01-012022-12-310001612630us-gaap:CustomerRelationshipsMembersrt:MaximumMember2022-01-012022-12-310001612630us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001612630us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001612630us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001612630us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001612630us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2022-06-300001612630us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjynt:SaleOfCompanyManagedClinicsMember2022-01-012022-12-310001612630us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjynt:SaleOfCompanyManagedClinicsMember2022-10-31xbrli:pure0001612630us-gaap:RestrictedStockMember2022-01-012022-12-310001612630us-gaap:RestrictedStockMember2021-01-012021-12-310001612630us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001612630us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001612630srt:ScenarioPreviouslyReportedMember2022-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-12-310001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2022-01-012022-12-310001612630jynt:RegionalDeveloperFeesMember2022-01-012022-12-310001612630srt:ScenarioPreviouslyReportedMember2022-01-012022-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-12-310001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-12-310001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-12-310001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2020-12-310001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2020-12-310001612630srt:ScenarioPreviouslyReportedMember2020-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2020-12-310001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-12-310001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2021-12-310001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2021-12-310001612630srt:ScenarioPreviouslyReportedMember2021-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2021-12-310001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-12-310001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2022-12-310001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2022-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2022-12-310001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-12-310001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2021-01-012021-12-310001612630jynt:RegionalDeveloperFeesMember2021-01-012021-12-310001612630srt:ScenarioPreviouslyReportedMember2021-01-012021-12-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-12-310001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-12-310001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-12-31jynt:state0001612630us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001612630us-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001612630us-gaap:TransferredOverTimeMember2022-01-012022-12-310001612630us-gaap:TransferredOverTimeMember2021-01-012021-12-3100016126302023-01-012022-12-3100016126302024-01-012022-12-3100016126302025-01-012022-12-3100016126302026-01-012022-12-3100016126302027-01-012022-12-3100016126302028-01-012022-12-310001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMember2022-05-192022-05-19jynt:franchise0001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMember2022-05-190001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMember2022-07-052022-07-050001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMember2022-07-050001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:FranchiseRightsMember2022-05-190001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:FranchiseRightsMembersrt:MinimumMember2022-05-192022-05-190001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:FranchiseRightsMembersrt:MaximumMember2022-05-192022-05-190001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:CustomerRelationshipsMember2022-05-190001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:CustomerRelationshipsMembersrt:MinimumMember2022-05-192022-05-190001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:CustomerRelationshipsMembersrt:MaximumMember2022-05-192022-05-190001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-07-292022-07-290001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-07-290001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-10-132022-10-130001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-10-130001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-10-242022-10-240001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-10-240001612630jynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-12-232022-12-230001612630jynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-12-230001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2022-07-290001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMembersrt:MinimumMember2022-07-292022-07-290001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMembersrt:MaximumMember2022-07-292022-07-290001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberus-gaap:CustomerRelationshipsMember2022-07-290001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberus-gaap:CustomerRelationshipsMembersrt:MinimumMember2022-07-292022-07-290001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberus-gaap:CustomerRelationshipsMembersrt:MaximumMember2022-07-292022-07-290001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberjynt:AssembledWorkforceMember2022-07-290001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberjynt:AssembledWorkforceMember2022-07-292022-07-290001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-12-230001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementCaliforniaMembersrt:MinimumMember2022-12-232022-12-230001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementCaliforniaMembersrt:MaximumMember2022-12-232022-12-230001612630us-gaap:CustomerRelationshipsMemberjynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-12-230001612630us-gaap:CustomerRelationshipsMemberjynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-12-232022-12-230001612630jynt:AssembledWorkforceMemberjynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-12-230001612630jynt:AssembledWorkforceMemberjynt:AssetAndFranchisePurchaseAgreementCaliforniaMember2022-12-232022-12-230001612630jynt:AssetsAndFranchiseAgreementMember2022-01-012022-12-310001612630jynt:AssetsAndFranchiseAgreementMember2021-01-012021-12-310001612630jynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMember2021-04-012021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMember2021-04-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMember2021-04-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMembersrt:MinimumMember2021-04-012021-04-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMembersrt:MaximumMember2021-04-012021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMemberus-gaap:CustomerRelationshipsMember2021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementPhoenixArizonaMemberus-gaap:CustomerRelationshipsMember2021-04-012021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2021-04-012021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2021-11-012021-11-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2021-11-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2021-04-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMembersrt:MinimumMember2021-04-012021-04-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMembersrt:MaximumMember2021-04-012021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberus-gaap:CustomerRelationshipsMember2021-04-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberus-gaap:CustomerRelationshipsMember2021-04-012021-04-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMember2021-11-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMembersrt:MinimumMember2021-11-012021-11-010001612630us-gaap:FranchiseRightsMemberjynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMembersrt:MaximumMember2021-11-012021-11-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberus-gaap:CustomerRelationshipsMember2021-11-010001612630jynt:AssetAndFranchisePurchaseAgreementNorthCarolinaMemberus-gaap:CustomerRelationshipsMember2021-11-012021-11-010001612630us-gaap:OfficeEquipmentMember2022-12-310001612630us-gaap:OfficeEquipmentMember2021-12-310001612630us-gaap:LeaseholdImprovementsMember2022-12-310001612630us-gaap:LeaseholdImprovementsMember2021-12-310001612630us-gaap:SoftwareDevelopmentMember2022-12-310001612630us-gaap:SoftwareDevelopmentMember2021-12-310001612630jynt:LeasedAssetsMember2022-12-310001612630jynt:LeasedAssetsMember2021-12-310001612630jynt:PropertyPlantAndEquipmentExcludingConstructionInProgressMember2022-12-310001612630jynt:PropertyPlantAndEquipmentExcludingConstructionInProgressMember2021-12-310001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:FranchiseRightsMember2022-12-310001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberus-gaap:CustomerRelationshipsMember2022-12-310001612630jynt:AssetAndFranchisePurchaseAgreementArizonaMemberjynt:AssembledWorkforceMember2022-12-310001612630us-gaap:FranchiseRightsMember2022-12-310001612630us-gaap:CustomerRelationshipsMember2022-12-310001612630jynt:AssembledWorkforceMember2022-12-310001612630us-gaap:FranchiseRightsMember2021-12-310001612630us-gaap:CustomerRelationshipsMember2021-12-310001612630jynt:AssembledWorkforceMember2021-12-310001612630us-gaap:FranchiseRightsMember2022-01-012022-12-310001612630us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001612630jynt:AssembledWorkforceMember2022-01-012022-12-310001612630jynt:SeniorSecuredCreditFacilitiesMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2020-02-280001612630us-gaap:RevolvingCreditFacilityMemberjynt:SeniorSecuredCreditFacilitiesMemberus-gaap:LineOfCreditMember2020-02-280001612630jynt:SeniorSecuredCreditFacilitiesMemberjynt:DevelopmentLineOfCreditMemberus-gaap:LineOfCreditMember2020-02-280001612630us-gaap:LetterOfCreditMemberjynt:SeniorSecuredCreditFacilitiesMemberus-gaap:LineOfCreditMember2020-02-280001612630us-gaap:RevolvingCreditFacilityMemberjynt:A2022CreditFacilityMemberus-gaap:LineOfCreditMember2022-02-280001612630us-gaap:RevolvingCreditFacilityMemberjynt:SeniorSecuredCreditFacilitiesMemberus-gaap:LineOfCreditMember2022-02-280001612630jynt:A2022CreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2022-02-280001612630us-gaap:LetterOfCreditMemberjynt:SeniorSecuredCreditFacilitiesMemberus-gaap:LineOfCreditMember2022-02-280001612630jynt:A2022CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-02-280001612630jynt:SeniorSecuredCreditFacilitiesMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-02-280001612630jynt:SeniorSecuredCreditFacilitiesMemberjynt:DevelopmentLineOfCreditMemberus-gaap:LineOfCreditMember2022-02-280001612630us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberjynt:A2022CreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2022-02-282022-02-280001612630us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberjynt:A2022CreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-02-282022-02-280001612630us-gaap:RevolvingCreditFacilityMemberjynt:A2022CreditFacilityMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-02-282022-02-280001612630us-gaap:RevolvingCreditFacilityMemberjynt:A2022CreditFacilityMemberjynt:FederalReserveBankOfNewYorkRateMemberus-gaap:LineOfCreditMember2022-02-282022-02-280001612630us-gaap:ReclassificationOtherMember2021-12-310001612630us-gaap:RevolvingCreditFacilityMemberjynt:SeniorSecuredCreditFacilitiesMemberus-gaap:LineOfCreditMember2022-12-310001612630us-gaap:RevolvingCreditFacilityMemberjynt:A2022CreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001612630us-gaap:RevolvingCreditFacilityMemberjynt:A2022CreditFacilityMemberus-gaap:LineOfCreditMember2021-12-310001612630us-gaap:RevolvingCreditFacilityMemberjynt:A2022CreditFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001612630us-gaap:RevolvingCreditFacilityMemberjynt:A2022CreditFacilityMemberus-gaap:LineOfCreditMember2021-01-012021-12-310001612630jynt:PaycheckProtectionProgramCARESActMemberexch:JPCB2020-04-100001612630jynt:PaycheckProtectionProgramCARESActMemberexch:JPCB2020-04-090001612630jynt:PaycheckProtectionProgramCARESActMemberexch:JPCB2021-03-040001612630us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001612630srt:MaximumMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001612630us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001612630srt:MinimumMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001612630us-gaap:EmployeeStockOptionMember2020-12-310001612630us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001612630us-gaap:EmployeeStockOptionMember2021-12-310001612630us-gaap:EmployeeStockOptionMember2022-12-310001612630us-gaap:RestrictedStockMember2022-12-31jynt:installment0001612630us-gaap:RestrictedStockMember2022-01-012022-12-310001612630us-gaap:RestrictedStockMember2020-12-310001612630us-gaap:RestrictedStockMember2021-01-012021-12-310001612630us-gaap:RestrictedStockMember2021-12-310001612630us-gaap:DomesticCountryMember2022-12-310001612630us-gaap:DomesticCountryMember2021-12-310001612630us-gaap:StateAndLocalJurisdictionMember2022-12-310001612630us-gaap:StateAndLocalJurisdictionMember2021-12-310001612630us-gaap:ResearchMember2022-12-310001612630jynt:CaliforniaAlternativeMinimumTaxCreditMember2022-12-310001612630srt:MinimumMember2022-12-310001612630srt:MaximumMember2022-12-31jynt:leasejynt:segment0001612630jynt:CorporateClinicsMember2022-01-012022-12-310001612630jynt:CorporateClinicsMember2021-01-012021-12-310001612630jynt:FranchiseOperationsMember2022-01-012022-12-310001612630jynt:FranchiseOperationsMember2021-01-012021-12-310001612630us-gaap:CorporateMember2022-01-012022-12-310001612630us-gaap:CorporateMember2021-01-012021-12-310001612630jynt:CorporateClinicsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001612630jynt:CorporateClinicsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001612630us-gaap:OperatingSegmentsMemberjynt:FranchiseOperationsMember2022-01-012022-12-310001612630us-gaap:OperatingSegmentsMemberjynt:FranchiseOperationsMember2021-01-012021-12-310001612630us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001612630us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001612630us-gaap:OperatingSegmentsMember2022-01-012022-12-310001612630us-gaap:OperatingSegmentsMember2021-01-012021-12-310001612630jynt:CorporateClinicsMemberus-gaap:OperatingSegmentsMember2022-12-310001612630jynt:CorporateClinicsMemberus-gaap:OperatingSegmentsMember2021-12-310001612630us-gaap:OperatingSegmentsMemberjynt:FranchiseOperationsMember2022-12-310001612630us-gaap:OperatingSegmentsMemberjynt:FranchiseOperationsMember2021-12-310001612630us-gaap:OperatingSegmentsMember2022-12-310001612630us-gaap:OperatingSegmentsMember2021-12-310001612630jynt:FranchiseLicensesMembersrt:DirectorMember2020-12-012020-12-310001612630srt:DirectorMemberjynt:FranchiseLicensesOneMember2020-12-012020-12-310001612630srt:DirectorMemberjynt:FranchiseLicensesTwoMember2020-12-012020-12-310001612630jynt:BanderaPartnersLLCMemberjynt:FranchiseLicensesMembersrt:DirectorMember2020-12-310001612630jynt:BanderaPartnersLLCMemberjynt:FranchiseLicensesMembersrt:DirectorMember2022-12-310001612630jynt:MrGrammMember2022-01-012022-12-310001612630jynt:MrGrammMember2021-01-012021-12-310001612630srt:ScenarioPreviouslyReportedMember2022-03-310001612630srt:ScenarioPreviouslyReportedMember2022-06-300001612630srt:ScenarioPreviouslyReportedMember2022-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-09-3000016126302022-03-3100016126302022-09-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-03-310001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2022-04-012022-06-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2022-07-012022-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2022-01-012022-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2022-04-012022-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2022-07-012022-09-300001612630jynt:RegionalDeveloperFeesMember2022-01-012022-03-310001612630jynt:RegionalDeveloperFeesMember2022-04-012022-06-300001612630jynt:RegionalDeveloperFeesMember2022-07-012022-09-300001612630srt:ScenarioPreviouslyReportedMember2022-01-012022-03-310001612630srt:ScenarioPreviouslyReportedMember2022-04-012022-06-300001612630srt:ScenarioPreviouslyReportedMember2022-07-012022-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-04-012022-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-07-012022-09-3000016126302022-01-012022-03-3100016126302022-04-012022-06-3000016126302022-07-012022-09-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-03-310001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2022-04-012022-06-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2022-07-012022-09-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-03-310001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-04-012022-06-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-07-012022-09-300001612630us-gaap:FranchiseMember2022-01-012022-03-310001612630us-gaap:FranchiseMember2022-04-012022-06-300001612630us-gaap:FranchiseMember2022-07-012022-09-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-06-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2022-01-012022-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2022-01-012022-09-300001612630jynt:RegionalDeveloperFeesMember2022-01-012022-06-300001612630jynt:RegionalDeveloperFeesMember2022-01-012022-09-300001612630srt:ScenarioPreviouslyReportedMember2022-01-012022-06-300001612630srt:ScenarioPreviouslyReportedMember2022-01-012022-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-09-3000016126302022-01-012022-06-3000016126302022-01-012022-09-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-06-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2022-01-012022-09-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-06-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-09-300001612630us-gaap:FranchiseMember2022-01-012022-06-300001612630us-gaap:FranchiseMember2022-01-012022-09-300001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2022-03-310001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2022-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2022-03-310001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-03-310001612630us-gaap:RetainedEarningsMember2022-03-310001612630us-gaap:ParentMember2022-03-310001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2022-06-300001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2022-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2022-06-300001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-06-300001612630us-gaap:RetainedEarningsMember2022-06-300001612630us-gaap:ParentMember2022-06-300001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2022-09-300001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2022-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2022-09-300001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-09-300001612630us-gaap:RetainedEarningsMember2022-09-300001612630us-gaap:ParentMember2022-09-300001612630srt:ScenarioPreviouslyReportedMember2021-03-310001612630srt:ScenarioPreviouslyReportedMember2021-06-300001612630srt:ScenarioPreviouslyReportedMember2021-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-09-3000016126302021-03-3100016126302021-06-3000016126302021-09-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-03-310001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2021-04-012021-06-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2021-07-012021-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2021-01-012021-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2021-04-012021-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2021-07-012021-09-300001612630jynt:RegionalDeveloperFeesMember2021-01-012021-03-310001612630jynt:RegionalDeveloperFeesMember2021-04-012021-06-300001612630jynt:RegionalDeveloperFeesMember2021-07-012021-09-300001612630srt:ScenarioPreviouslyReportedMember2021-01-012021-03-310001612630srt:ScenarioPreviouslyReportedMember2021-04-012021-06-300001612630srt:ScenarioPreviouslyReportedMember2021-07-012021-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-04-012021-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-07-012021-09-3000016126302021-01-012021-03-3100016126302021-04-012021-06-3000016126302021-07-012021-09-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-03-310001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2021-04-012021-06-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2021-07-012021-09-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-03-310001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-04-012021-06-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-07-012021-09-300001612630us-gaap:FranchiseMember2021-01-012021-03-310001612630us-gaap:FranchiseMember2021-04-012021-06-300001612630us-gaap:FranchiseMember2021-07-012021-09-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-06-300001612630jynt:RegionalDeveloperFeesMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2021-01-012021-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjynt:RegionalDeveloperFeesMember2021-01-012021-09-300001612630jynt:RegionalDeveloperFeesMember2021-01-012021-06-300001612630jynt:RegionalDeveloperFeesMember2021-01-012021-09-300001612630srt:ScenarioPreviouslyReportedMember2021-01-012021-06-300001612630srt:ScenarioPreviouslyReportedMember2021-01-012021-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-09-3000016126302021-01-012021-06-3000016126302021-01-012021-09-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-06-300001612630us-gaap:FranchiseMembersrt:ScenarioPreviouslyReportedMember2021-01-012021-09-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-06-300001612630us-gaap:FranchiseMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-09-300001612630us-gaap:FranchiseMember2021-01-012021-06-300001612630us-gaap:FranchiseMember2021-01-012021-09-300001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2021-03-310001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2021-03-310001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2021-03-310001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-03-310001612630us-gaap:RetainedEarningsMember2021-03-310001612630us-gaap:ParentMember2021-03-310001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2021-06-300001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2021-06-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2021-06-300001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-06-300001612630us-gaap:RetainedEarningsMember2021-06-300001612630us-gaap:ParentMember2021-06-300001612630us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2021-09-300001612630us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2021-09-300001612630srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2021-09-300001612630us-gaap:ParentMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-09-300001612630us-gaap:RetainedEarningsMember2021-09-300001612630us-gaap:ParentMember2021-09-300001612630us-gaap:SubsequentEventMember2023-03-012023-03-10

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1 to Form 10-K) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to ________

Commission File Number: 001-36724

The Joint Corp.

(Exact name of registrant as specified in its charter) | | | | | |

| Delaware | 90-0544160 |

(State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) |

| | | | | |

16767 North Perimeter Drive, Suite 110, Scottsdale, Arizona | 85260 |

| (Address of Principal Executive Offices) | (Zip Code) |

(480) 245-5960

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Trading | |

| Title Of Each Class | Symbol(s) | Name Of Each Exchange On Which Registered |

| Common Stock, $0.001 Par Value Per Share | JYNT | The NASDAQ Capital Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☑

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | |

Large accelerated Filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☑ | Smaller reporting company ☑ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☑

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $136.9 million as of June 30, 2022 based on the closing sales price of the common stock on the NASDAQ Capital Market.

There were 14,570,879 shares of the registrant’s common stock outstanding as of March 1, 2023.

Documents Incorporated by Reference

Portions of the registrant's Proxy Statement relating to its 2023 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission (“SEC”) pursuant to Regulation 14A within 120 days after the registrant’s fiscal year ended December 31, 2022, are incorporated by reference in Part III of this Form 10-K.

EXPLANATORY NOTE

The Joint Corp. (the “Company”) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 with the U.S. Securities and Exchange Commission (“SEC”) on March 10, 2023 (the “Original Form 10-K”). This Comprehensive Form 10-K/A contains the restatement of the following previously filed periods: (i) our audited consolidated financial statements for the fiscal year ended December 31, 2022, (ii) our audited consolidated financial statements for the fiscal year ended December 31, 2021, (iii) our unaudited consolidated financial statements covering the quarterly reporting periods during fiscal year 2022, consisting of the quarters ended June 30, 2022, and September 30, 2022; and (iv) our unaudited consolidated financial statements covering the quarterly reporting periods during fiscal year 2021, consisting of the quarters ended March 31, 2021, June 30, 2021, and September 30, 2021. This Amendment also amends the Company’s conclusions and disclosures included in Item 9A Controls and Procedures of the Original Form 10-K related to disclosure controls and procedures and internal control over financial reporting.

Restatement Background

As previously disclosed, on August 30, 2023, the Chief Financial Officer of the Company, after meeting with the members of the Audit Committee to discuss the matters disclosed herein and in consultation with BDO USA, P.C. (“BDO”), the Company’s independent registered public accounting firm, concluded that the Company’s previously issued audited financial statements as of and for the year ending December 31, 2022 contained in the Annual Report on Form 10-K for the year ended December 31, 2022 and the unaudited interim financial statements contained in the Quarterly Reports on Form 10-Q for the quarters and cumulative periods ended June 30, 2022, and September 30, 2022 (the “2022 Previously Issued Financial Statements”) contained material errors and should be restated, which conclusion was thereafter formally ratified by the Audit Committee and the Board of Directors of the Company. On September 11, 2023, the Chief Financial Officer of the Company, after meeting with the members of the Audit Committee to discuss the matters disclosed herein and in consultation with BDO, further concluded that the Company’s previously issued audited financial statements as of and for the year ending December 31, 2021 contained in the Annual Report on Form 10-K for the year ended December 31, 2022 and the unaudited interim financial statements contained in the Quarterly Reports on Form 10-Q for the quarters and cumulative periods ended March 31, 2022 and 2021, June 30, 2021, and September 30, 2021 (the “Additional Previously Issued Financial Statements,” and together with the 2022 Previously Issued Financial Statements, the “Previously Issued Financial Statements”) contained material errors and should be restated, which conclusion was thereafter formally ratified by the Board of Directors of the Company. These determinations occurred following discussions of the matter among BDO, officers of the Company and members of the Company’s Board of Directors. Accordingly, investors and all other persons should no longer rely upon the Previously Issued Financial Statements included in the Company’s previously filed Form 10-K and Form 10-Qs for the periods listed above. In addition, any previously issued or filed earnings releases, investor presentations or other communications describing the Previously Issued Financial Statements and other related financial information covering these periods should no longer be relied upon.

The Company enters into agreements with its regional developers (the “RD Agreements”). Under each RD Agreement, the Company sells to each of its regional developers the exclusive rights to open a minimum number of clinics in a defined territory (the “Regional Developer Rights”). Upon entering into each RD Agreement, the regional developer pays the Company an upfront fee for such Regional Developer Rights. Each regional developer helps the Company to identify and qualify potential new franchisees in its territory and assists the Company in providing field training, clinic openings and ongoing support. In return, the Company shares with the regional developer part of the initial upfront franchise fee paid to the Company by new franchisees in the regional developer’s protected territory and pays the regional developer 3% of the 7% ongoing royalties the Company collects from the franchisees in the regional developer’s protected territory. From time to time, the Company has re-acquired Regional Developer Rights from certain of its regional developers.

Historically, the Company has recorded the re-acquired Regional Developer Rights as an intangible asset and amortized the re-acquired Regional Developer Rights over the contractual terms under the RD Agreement remaining at the time of the re-acquisition. The Company has concluded that this treatment was incorrect in accordance with U.S. GAAP. The Company should not have capitalized the re-acquired Regional Developer Rights but instead should have recognized the full cost of the re-acquisition as an expense in the respective period. In addition, the Company has historically recorded the upfront fee paid by the regional developer as a deferred liability, which was then recognized ratably to revenue as the regional developer performed various service obligations. The amended treatment will still defer the upfront payment, but the deferred liability will be ratably recognized against cost of revenue as an offset against future commissions.

Additionally, the Company files standalone Federal corporate and State tax returns as well as city income and franchise tax returns for itself and its four variable interest entities (“VIEs") which it controls under its corresponding management

agreements. The four VIEs were set up due to the various States’ regulatory and legal requirements. The Joint Corp has management agreements with each of the four VIEs (“PCs or professional corporations”).

The Company has historically charged the VIEs a management fee for the benefit of the Company providing non-clinical administrative services needed by the professional corporation chiropractic practice. However, the standalone professional corporations have not historically been profitable from an income tax perspective and are fully valuing their deferred tax assets and related attributes for ASC 740 purposes. As such, the Company has initiated a review of its transfer pricing with the VIEs.

The economic compensation or profitability resulting from an intercompany transaction between two or more parties is based on each party’s relative contribution to the economic activity under analysis. Or stated in transfer pricing terms, the economic compensation or profitability from an intercompany transaction is based on each party’s functions performed, risks assumed, and assets employed in the activity.

Overall, the PCs' earned annual losses were not consistent with their function, risk, and asset profile for transfer pricing. As such, the Company has estimated transfer pricing adjustments which were computed based on assumed targets of profitability. The resulting operating profit, after incorporating estimated transfer pricing adjustments, were further used as a means for computing overall potential tax exposure and correlative benefit.

Internal Control Considerations

As a result of this restatement, the Company’s management has re-evaluated the effectiveness of the Company’s internal control over financial reporting as of December 31, 2022, and the quarterly periods therein. Management has concluded that the Company's internal control over financial reporting were not effective as of December 31, 2022, due to material weaknesses in internal controls over the accounting of complex areas, including income taxes, revenue recognition and asset acquisition transactions.

For a discussion of management’s considerations of the Company’s internal control over financial reporting and the material weaknesses identified, refer to Controls and Procedures in Part II, Item 9A.

Items Amended in this Form 10-K/A

This Comprehensive Form 10-K/A for the fiscal years ended December 31, 2022, and December 31, 2021, reflects changes to the Consolidated Balance Sheet at December 31, 2022, and December 31, 2021, and the Consolidated Income Statements, Statements of Stockholders’ Equity, and Statements of Cash Flows for the years ended December 31, 2022, and December 31, 2021, and the related notes thereto. Restatement of consolidated financial statements for the fiscal years ended December 31, 2022, and December 31, 2021, are disclosed in Note 2 to the consolidated financial statements. Restatement of consolidated financial statements for the quarterly and year-to-date periods in fiscal years 2022 and 2021 are disclosed in Note 14 to the consolidated financial statements. Other sections impacted are:

• Part I, Item 1A, Risk Factors

• Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations

• Part II, Item 9A, Controls and Procedures

• Part IV, Item 15, Exhibits and Financial Statement Schedules

The Company has not filed, and does not intend to file, amendments to the previously filed Quarterly Reports on Form 10-Q for any of the quarters for the years ended December 31, 2022, and December 31, 2021, nor the previously filed Annual Report on Form 10-K for the fiscal year ended December 31, 2021. Accordingly, investors should rely only on the financial information and other disclosures regarding the restated periods in this Form 10-K/A or in future filings with the SEC (as applicable), and not on any previously issued or filed reports, earnings releases or similar communications relating to these periods.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), new certifications by the Company’s principal executive officer and principal financial officer are filed herewith as exhibits to this Form 10-K/A pursuant to Rule 13a-14(a) of the Exchange Act and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350).

See Note 2 and Note 14 to the consolidated financial statements, included in Part II, Item 8 of this Form 10-K/A, for additional information on the restatement and the related consolidated financial statement effects.

Except as described above, this Amendment does not amend, update or change any other disclosures in the Original Form 10-K. In addition, the information contained in this Amendment does not reflect events occurring after the Original Form 10-K and

does not modify or update the disclosures therein, except to reflect the effects of the restatement as well as certain disclosures regarding the one-time waiver by JP Morgan Chase of certain defaults resulting from the late filing of our Quarterly Statement on Form 10-Q for the period ended June 30, 2023. This Amendment should be read in conjunction with the Company’s other filings with the SEC.

Forward-Looking Statements and Terminology

The information in this Annual Report on Form 10-K, or this Form 10-K, including this discussion under the headings “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, included or incorporated in this Form 10-K could be deemed forward-looking statements, particularly statements about our plans, strategies and prospects under the headings “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “intend,” “seek,” “strive,” or the negative of these terms, “mission,” “goal,” “objective,” or “strategy,” or other comparable terminology. All forward-looking statements in this Form 10-K are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations as described from time to time in our SEC reports, including those risks outlined under “Risk Factors” in Item 1A of this Form 10-K. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in this Form 10-K. You should carefully consider the trends, risks and uncertainties described below and other information in this Form 10-K and subsequent reports filed with or furnished to the SEC before making any investment decision with respect to our securities. We undertake no obligation to update or revise publicly any forward-looking statements, other than in accordance with legal and regulatory obligations. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. Some of the important factors that could cause our actual results to differ materially from those projected in any forward-looking statements include, but are not limited to, the following:

•the nationwide labor shortage has negatively impacted our ability to recruit chiropractors and other qualified personnel, which may limit our growth strategy, and the measures we have taken in response to the labor shortage have reduced our net revenues;

•inflation, exacerbated by COVID-19 and the Ukraine War, has led to increased labor costs and interest rates and may lead to reduced discretionary spending, all of which may negatively impact our business;

•the COVID-19 pandemic has caused significant disruption to our operations and may continue to impact our business, key financial and operating metrics, and results of operations in numerous ways that remain unpredictable; future widespread outbreaks of contagious disease could similarly disrupt our business;

•we may not be able to successfully implement our growth strategy if we or our franchisees are unable to locate and secure appropriate sites for clinic locations, obtain favorable lease terms, and attract patients to our clinics;

•we have limited experience operating company-owned or managed clinics in those geographic areas where we currently have few or no clinics, and we may not be able to duplicate the success of some of our franchisees;

•we may not be able to acquire operating clinics from existing franchisees or develop company-owned or managed clinics on attractive terms;

•we have restated our prior consolidated financial statements, which may lead to additional risks and uncertainties, including loss of investor confidence and negative impacts on our stock price;

•short-selling strategies and negative opinions posted on the internet may drive down the market price of our common stock and could result in class action lawsuits;

•we have identified material weaknesses in our internal controls over financial reporting and we may fail to remediate material weaknesses in our internal controls over financial reporting or may otherwise be unable to maintain an effective system of internal control over financial reporting, which might negatively impact our ability to accurately report our financial results, prevent fraud, or maintain investor confidence;

•we may fail to successfully design and maintain our proprietary and third-party management information systems or implement new systems;

•we may fail to properly maintain the integrity of our data or to strategically implement, upgrade or consolidate existing information systems;

•franchised clinic acquisitions that we make could disrupt our business and harm our financial condition if we cannot continue their operational success or successfully integrate them;

•we may not be able to continue to sell franchises to qualified franchisees, and our franchisees may not succeed in developing profitable territories and clinics;

•new clinics may not reach the point of profitability, and we may not be able to maintain or improve revenues and franchise fees from existing franchised clinics;

•the chiropractic industry is highly competitive, with many well-established independent competitors, which could prevent us from increasing our market share or result in reduction in our market share;

•state administrative actions and rulings regarding the corporate practice of chiropractic may jeopardize our business model;

•expected new federal regulations and state laws and regulations regarding joint employer responsibility could negatively impact the franchise business model, increasing our potential liability for employment law violations by our franchisees and the likelihood that we may be required to participate in collective bargaining with our franchisees’ employees;

•an increased regulatory focus on the establishment of fair franchise practices could increase our risk of liability in disputes with franchisees and the risk of enforcement actions and penalties;

•negative publicity or damage to our reputation, which could arise from concerns expressed by opponents of chiropractic and by chiropractors operating under traditional service models, could adversely impact our operations and financial position;

•our IT security systems and those of our third-party service providers (as recently experienced by one of our marketing vendors) may be breached, and we may face civil liability and public perception of our security measures could be diminished, either of which would negatively affect our ability to attract and retain patients;

•legislation, regulations, as well as new medical procedures and techniques, could reduce or eliminate our competitive advantages; and

•the delayed filing of our quarterly report has made us currently ineligible to use a registration statement on Form S-3 to register the offer and sale of securities, which could adversely affect our ability to raise future capital or complete acquisitions.

Additionally, there may be other risks that are otherwise described from time to time in the reports that we file with the Securities and Exchange Commission. Any forward-looking statements in this report should be considered in light of various important factors, including the risks and uncertainties listed above, as well as others.

As used in this Form 10-K:

•“we,” “us,” and “our” refer to The Joint Corp., its variable interest entities (“VIEs”), and its wholly owned subsidiary, The Joint Corporate Unit No. 1, LLC, collectively.

•a “clinic” refers to a chiropractic clinic operating under our “Joint” brand, which may be (i) owned by a franchisee, (ii) owned by a professional corporation or limited liability company and managed by a franchisee; (iii) owned directly by us; or (iv) owned by a professional corporation or limited liability company and managed by us.

•when we identify an “operator” of a clinic, a party that is “operating” a clinic, or a party by whom a clinic is “operated,” we are referring to the party that operates all aspects of the clinic in certain jurisdictions, and to the party that manages all aspects of the clinic other than the practice of chiropractic in certain other jurisdictions.

•when we describe our acquisition of a clinic, we are referring to our acquisition of the assets of a clinic owned by one of our franchisees. When we describe our opening of a clinic, we are referring to our opening of a clinic that is owned or

managed by us from its inception. In certain jurisdictions, we manage all aspects of the clinics we acquire or open, and in certain other jurisdictions, we manage only those aspects of our clinics that do not relate to the practice of chiropractic.

PART I

ITEM 1. BUSINESS

| | |

"Our mission is to improve quality of life through routine and affordable chiropractic care." |

Overview

Our principal business is to develop, own, operate, support and manage chiropractic clinics through direct ownership, management arrangements, franchising and regional developers throughout the United States.

We are a rapidly growing franchisor and operator of chiropractic clinics that uses a private pay, non-insurance, cash-based model. We seek to be the leading provider of chiropractic care in the markets we serve and to become the most recognized brand in our industry through the rapid and focused expansion of chiropractic clinics in key markets throughout North America and potentially abroad. We strive to accomplish our mission by making quality care readily available and affordable in a retail setting. We have created a growing network of modern, consumer-friendly chiropractic clinics operated or managed by franchisees and by us that employ licensed chiropractors. Our model enables us to price our services below most competitors’ pricing for similar services and below most insurance co-payment levels (i.e., below the patient co-payment required for an insurance-covered service).

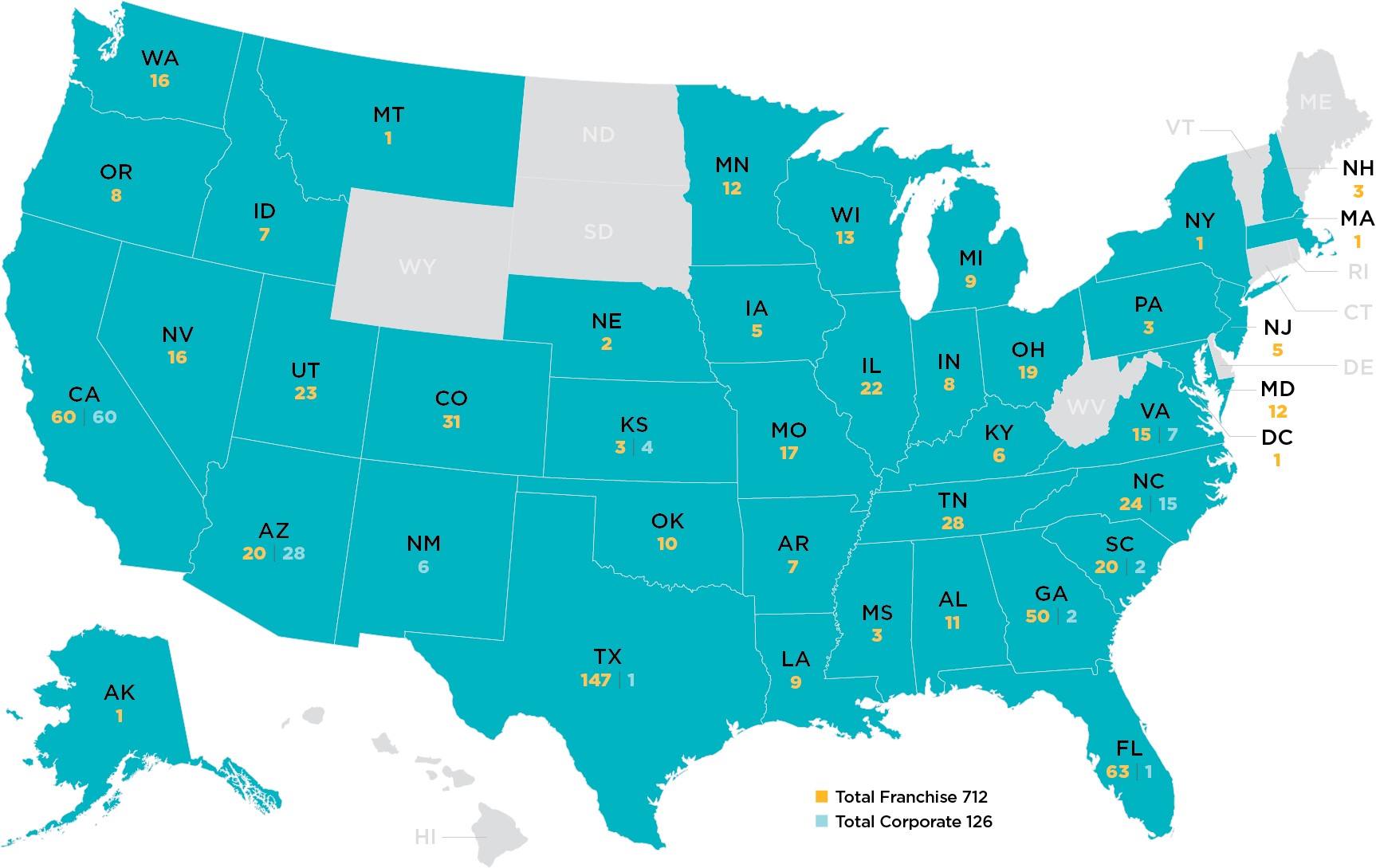

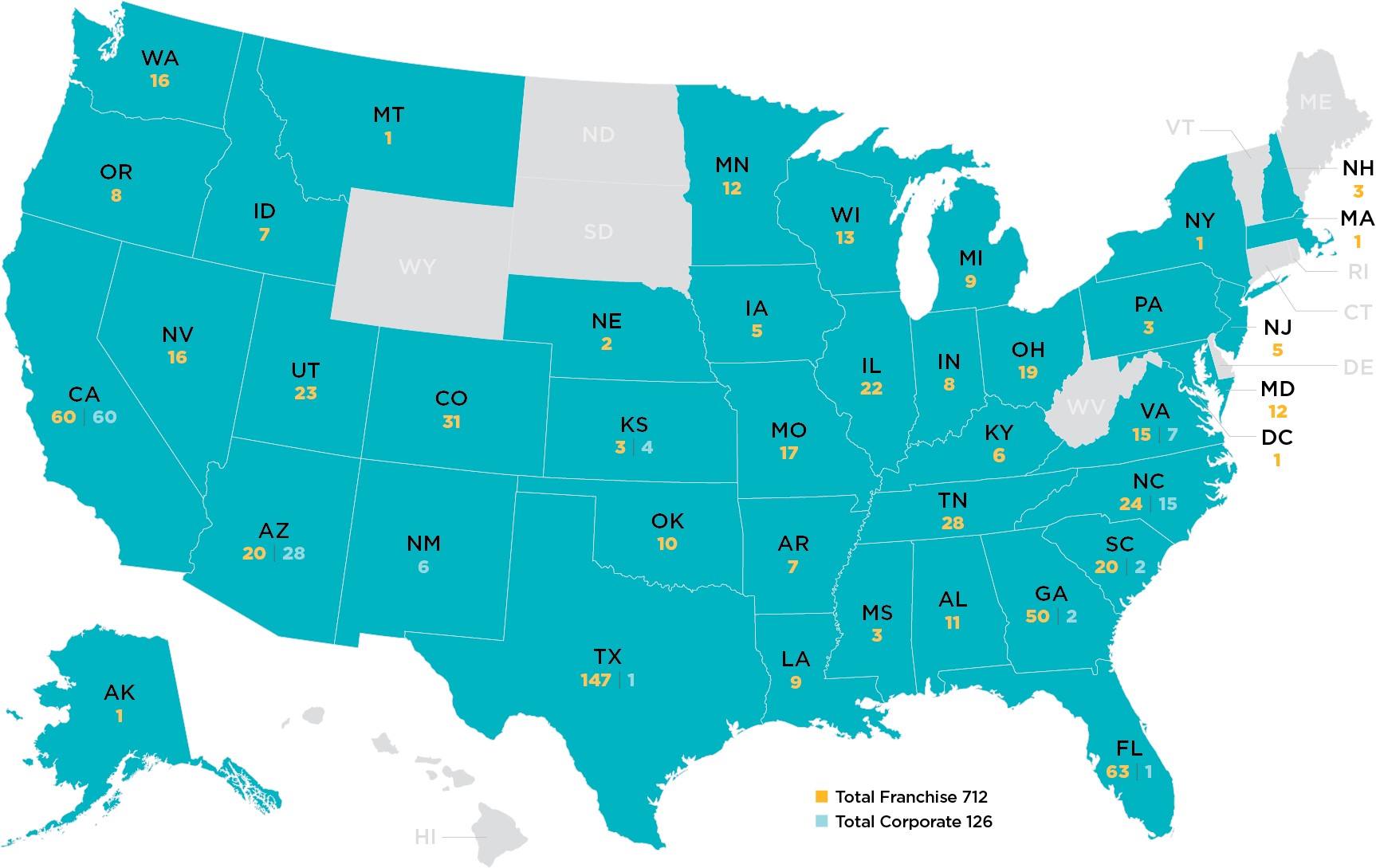

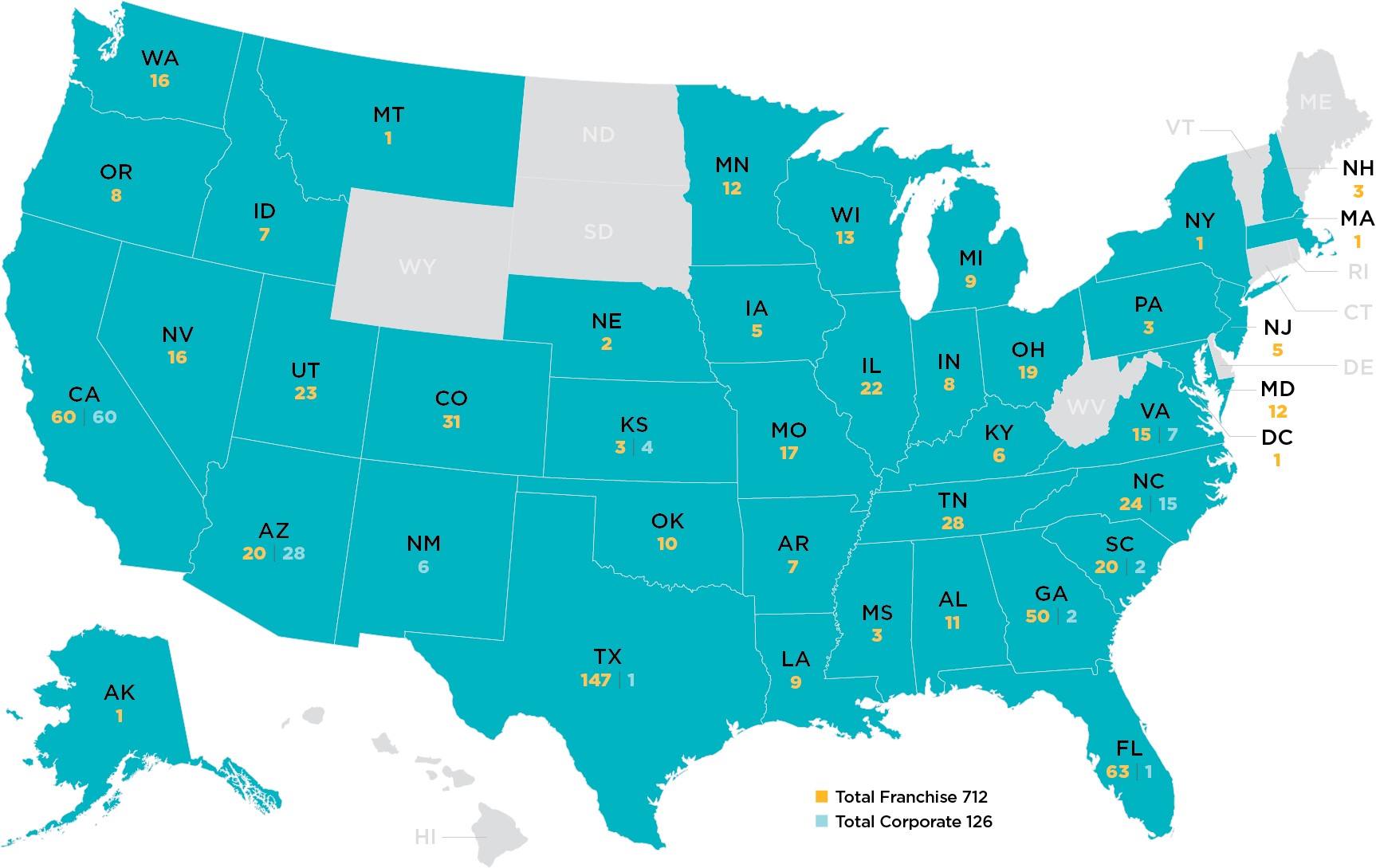

Since acquiring the predecessor to our company in March 2010, we have grown our enterprise from eight to 838 clinics in operation as of December 31, 2022, with an additional 197 franchise licenses sold but not yet developed across our network, and 38 letters-of-intent for 38 future clinic licenses. As of December 31, 2022, our franchisees owned or managed 712 clinics, and we owned or managed 126 clinics. In the year ended December 31, 2022, our system registered approximately 12.2 million patient visits and generated system-wide sales of $435.3 million. Our future growth strategy remains focused on accelerating the development of our franchise base through the sale of additional franchises and through a robust regional developer network. In 2023, we plan to continue our acceleration of the expansion of our company-owned or managed portfolio through the opportunistic acquisition of select operating clinics in addition to the development of new clinics. We collect a royalty of 7.0% of revenues from franchised clinics. We remit a 3.0% royalty to our regional developers on the gross sales of franchises opened within certain regional developer protected territories. We also collect a national marketing fee of 2.0% of gross sales of all franchised clinics. We receive a franchise sales fee of $39,900 for each franchise we sell directly and offer a veterans discount, as well as a discount for purchase of multiple location franchises. If a franchisee purchases additional franchise licenses, the initial franchise fee is reduced by $10,000 per additional license. For each franchise sold through our network of regional developers, the regional developer typically receives up to 50% of the respective franchise fee.

On November 14, 2014, we completed our initial public offering, or the IPO, of 3,000,000 shares of common stock at an initial price to the public of $6.50 per share, and we received net proceeds of approximately $17.1 million. Our underwriters exercised their option to purchase 450,000 additional shares of common stock to cover over-allotments on November 18, 2014, pursuant to which we received net proceeds of approximately $2.7 million. Also, in conjunction with the IPO, we issued warrants to the underwriters for the purchase of 90,000 shares of common stock, which were exercisable during the period between November 10, 2015 and November 10, 2018 at an exercise price of $8.125 per share. These warrants expired on November 10, 2018.

On November 25, 2015, we closed on our follow-on public offering of 2,272,727 shares of common stock, at a price to the public of $5.50 per share. We granted the underwriters a 45-day option to purchase up to 340,909 additional shares of common stock to cover over-allotments, if any. On December 30, 2015, our underwriters exercised their over-allotment option to purchase an additional 340,909 shares of common stock at a price of $5.50 per share. After giving effect to the over-allotment exercise, the total number of shares offered and sold in our follow-on public offering increased to 2,613,636 shares. With the over-allotment option exercise, we received aggregate net proceeds of approximately $13.3 million.

We deliver convenient, appointment-free chiropractic adjustments in an inviting, open bay environment at prices that are approximately 45% lower than the average industry cost for comparable procedures offered by traditional chiropractors, according to 2022 industry data from Chiropractic Economics. In support of our mission to offer quality, affordable and convenient care to our patients, our clinics offer a variety of customizable membership and wellness treatment plans which provide additional value pricing as compared with our single-visit pricing schedules. These flexible plans are designed to attract patients and encourage repeat visits and routine usage as part of an overall health and wellness program.

As of December 31, 2022, we had 838 franchised or company-owned or managed clinics in operation in 40 states. The map below shows the states in which we or our franchisees operate clinics and the number of clinics open in each state as of December 31, 2022.

Our retail locations have been selected to be visible, accessible and convenient. We offer a welcoming, consumer-friendly experience that attempts to redefine the chiropractic doctor/patient relationship. Our clinics are open longer hours than many of our competitors, including weekend days, and our patients do not need appointments. We accept cash or major credit cards in return for our services. We do not accept insurance and do not provide Medicare covered services. We believe that our approach, especially our commitment to affordable pricing and our ready service delivery model, will attract existing consumers of chiropractic services and will also appeal to the growing market of consumers who seek alternative or non-invasive wellness care, but have not yet tried chiropractic. According to our patient survey conducted in early 2023 by WestGroup Research, 35% of our new patients had never tried chiropractic care before they came to The Joint. This remains consistent with the strong outcome of 36% of patients new to chiropractic in the same survey conducted in 2022, and an increase from 27% in 2021, 26% in 2019, 22% in 2017, 21% in 2016, and 16% in 2013, demonstrating our continued impact on the chiropractic market and offering validation to our thesis that we are actually expanding the overall market for chiropractic.

Our patients arrive at our clinics without appointments at times convenient to their schedules. Once a patient has joined our system and is returning for treatment, they simply swipe their membership card at a card reader at the reception desk to announce their arrival. The patient is then escorted to our open adjustment area, where they are required to remove only their outerwear to receive their adjustment. Each patient’s records are digitally updated for retrieval in our proprietary data storage system by our chiropractors in compliance with all applicable medical records security and privacy regulations. The adjustment process, administered by a licensed chiropractor, takes approximately 15 - 20 minutes on average for a new patient and 5 - 7 minutes on average for a returning patient.

Our consumer-focused service model targets the non-acute treatment market, which is part of the $19.5 billion chiropractic services market, according to an IBIS market research report in March 2022. As our model does not focus on the treatment of severe or acute injury, we do not provide expensive and invasive diagnostic tools such as MRIs and X-rays. Instead, we refer those with severe or acute symptoms to alternate healthcare providers, including traditional chiropractors.

Our Industry

Chiropractic care is widely accepted among individuals with a variety of medical conditions, particularly back pain. A 2018 Gallup report commissioned by Palmer College of Chiropractic shows that among all U.S. adults, including those who did not have neck or back pain, 16% went to a chiropractor in the last 12 months. These numbers represent a marked increase over the 2012 National

Health Interview Survey that measured chiropractic use at 8% of the population. According to the American Chiropractic Association, 80% of Americans experience back pain at least once in their lifetime. According to the same 2018 Gallup report commissioned by the Palmer College of Chiropractic, eight in 10 adults in the United States (80%) prefer to see a health care professional who is an expert in spine-related conditions for neck or back pain care instead of a general medicine professional who treats a variety of conditions (15%).

Chiropractic care is increasingly recognized as an effective treatment for pain and potentially for a variety of other conditions. The American College of Physicians (ACP) now recommends non-drug therapy such as spinal manipulation as a first line of treatment for patients with chronic low-back pain. The ACP states that treatments such as spinal manipulation are shown to improve symptoms with little risk of harm. The National Center for Complementary & Alternative Medicine of the National Institutes of Health has stated that spinal manipulation appears to benefit some people with low-back pain and also may be helpful for headaches, neck pain, upper- and lower-extremity joint conditions and whiplash-associated disorders. The Mayo Clinic has recognized chiropractic as safe when performed by trained and licensed chiropractors, and the Cleveland Clinic has stated that chiropractors are established members of the mainstream medical team.

The chiropractic industry in the United States is large and highly fragmented. An article appearing in the Journal of the American Medical Association (JAMA) entitled “US Healthcare Spending by Payer and Health Condition, 1996-2016” estimates that $134 billion was spent in 2016 on back pain in the U.S. According to a report issued by IBIS World Chiropractors Market Research in March 2022, expenditures for chiropractic services in the U.S. are $19.5 billion annually. The United States Bureau of Labor Statistics expects employment in chiropractic to grow steadily. Some of the factors that the Bureau of Labor Statistics identified as driving this growth are healthcare cost pressures, an aging population requiring more health care and technological advances, all of which are expected to increasingly shift services from inpatient facilities and hospitals to outpatient settings. We believe that the demand for our chiropractic services will continue to grow as a result of several additional drivers, such as the growing recognition of the benefits of regular maintenance therapy coupled with an increasing awareness of the convenience of our service and of our pricing at a significant discount to the cost of traditional chiropractic adjustments and, in most cases, at or below the level of insurance co-payment amounts.

Today, most chiropractic services are provided by sole practitioners, generally in medical office settings. The chiropractic industry differs from the broader healthcare services industry in that it is more heavily consumer-driven, market-responsive and price sensitive, in large measure a result of many treatment options falling outside the bounds of traditional insurance reimbursable services and fee schedules. According to the March 2022 IBIS market research report, the three largest industry companies were each expected to generate less than 1% of total industry revenue in 2022. We believe these characteristics are evidence of an underserved market with potential consumer demand that is favorable for an efficient, low-cost, consumer-oriented provider.

Most chiropractic practices are set up to accept and to process insurance-based reimbursement. While chiropractors typically accept cash payment in addition to insurance, Medicare and Medicaid, they continue to incur overhead expenses associated with maintaining the capability to process third-party reimbursement. We believe that most chiropractors who use this third-party reimbursement model would find it economically difficult to discount the prices they charge for their services to levels comparable with our pricing.

Accordingly, we believe these and certain other trends favor our business model. Among these are:

•People, most notably Millennials – the largest portion of our patient base – have increasingly active lifestyles and are expected to live longer, requiring more medical, maintenance and preventative support;

•People are increasingly open to alternative, non-pharmacological types of care;

•Utilization of more conveniently situated, local-sited urgent-care or “mini-care” alternatives to primary care is increasing; and

•Popularity of health clubs, massage and other non-drug, non-invasive wellness maintenance providers is growing.

Our Competitive Strengths

We believe the following competitive strengths have contributed to our success and will continue to position us for future growth:

Retail, consumer-driven approach. To support our consumer-focused model, we use strong, recognizable retail approaches to stimulate brand-awareness and attract patients to our clinics. We intend to continue to drive awareness of our brand by continuing to locate clinics mainly at retail centers and convenience points, displaying prominent signage and employing consistent, proven and targeted marketing tools. We offer our patients the flexibility to visit our clinics without an appointment and receive prompt attention. Additionally, most of our clinics offer extended hours of operation, including weekends, which is not typical among our competitors.

We attracted an average of 1,229 new patients per clinic (for all clinics open for the full twelve months of 2022) during the year ended December 31, 2022, as compared to the most recent chiropractic industry average of 333 new patients per year for traditional

insurance-based non-multidisciplinary or integrated practices, according to a 2022 Chiropractic Economics survey (conducted in March and April of 2022).

Quality, Empathetic Service. Across our system we have a community of more than 2,455 fully licensed chiropractic doctors, who performed approximately 12.2 million adjustments in 2022 alone. Our doctors provide personal and intuitive patient care focused on pain relief and ongoing wellness to promote healthy, active lifestyles. We provide our doctors one-on-one training, as well as ongoing coaching and mentoring. Our doctors continually refine their skills, as our clinics see an average of 321 patient visits per week (for clinics open for the full twelve months of 2022), as compared to the most recent chiropractic industry average of 115 patients per week for non-multidisciplinary or integrated practices, according to the same 2022 Chiropractic Economics survey referred to above. Our service offerings encourage consumer trial, repeat visits and sustainable patient relationships.

By eliminating the administrative burdens of insurance processing, our model helps chiropractors focus on patient service. We believe the time our chiropractors save by not having to perform administrative duties related to insurance reimbursement allows more time to see more patients, establish and reinforce chiropractor/patient relationships, and educate patients on the benefits of chiropractic maintenance therapy.

Our approach has made us an attractive alternative for chiropractic doctors who want to spend more time treating patients than they typically do in traditional practices, which are burdened with greater overhead, personnel and administrative expense. We believe that our model helps us to recruit chiropractors who want to focus their practice principally on patient care.

Accessibility. We believe that our strongest competitive advantages are our convenience and affordability. By focusing on non-acute care in an open-bay environment and by not participating in insurance or Medicare reimbursement, we are able to offer a much less expensive alternative to traditional chiropractic services. We can do this because our clinics do not have the expenses of performing certain diagnostic procedures and processing reimbursement claims. Our model allows us to pass these savings on to our patients. According to Chiropractic Economics, in 2022, the average fee for a chiropractic treatment involving spinal manipulation in a cash-based practice in the United States is approximately $65. By comparison, our average fee as of December 31, 2022 was approximately $36, approximately 45% lower than the industry average price.

We believe our pricing and service offering structure helps us to generate higher usage. The following table sets forth our average price per adjustment as of December 31, 2022 for patients who pay by single adjustment plans, multiple adjustment packages, and multiple adjustment membership plans. Our price per adjustment as of December 31, 2022 averaged approximately $36 across all three groups.

| | | | | | | | | | | | | | | | | |

| The Joint Service Offering |

| Single Visit | | Package(s) | | Membership(s) |

| Price per adjustment | $45 | | $19—$35 | | $17—$22 |

Proven track record of opening clinics and growing revenue at the clinic level. We have grown our clinic revenue base consistently. From January 2012 through December 31, 2022, we have increased the annual system-wide sales from $22.3 million to $435.3 million (which includes $59.4 million of revenue from clinics owned or operated by us and $375.9 million from clinics operated by our franchisees, which is a non-GAAP measure for the year ended December 31, 2022). During this period, we increased the number of clinics in operation from 33 to 838.

We continue to be encouraged by the ability of individual clinics to generate growth. While there is significant variation in results in our system, and the results of our top-performing clinics are not representative of our system overall, we believe it is worth noting that in January 2012, the highest-performing clinic in our system was a franchised clinic which had monthly sales of approximately $45,000, and in December 2022, the highest performing clinic in our system was a franchised clinic which had monthly sales of approximately $166,000.

Strong and proven management team. Our strategic vision is directed by our president and chief executive officer, Peter D. Holt, who has more than 35 years of experience in domestic and international franchising, franchise development and operations. Under his direction, we have confirmed our commitment to the continued strengthening of operations, the continued cultivation and management of our franchise community, as well as a strong commitment to future clinic development both domestically and internationally. Mr. Holt was president and chief executive officer of Tasti-D-Lite. He has also served as chief operating officer of 24seven Vending (U.S), where he directed its franchise system in the U.S., and as executive vice president of development for Mail Boxes Etc. and vice

president of international for I Can’t Believe It’s Yogurt and Java Coast Fine Coffees. Mr. Holt directs a team of dedicated leaders who are focused on executing our business plan and implementing our growth strategy.

Mr. Holt has assembled a strong management team, including Jake Singleton as chief financial officer since November 2018. In addition to valuable institutional memory from his over three years serving as our corporate controller before assuming the role of CFO, Mr. Singleton has financial and accounting experience from his time with the public accounting firm Ernst & Young LLP.

Krischelle Tennessen joined as chief human resources officer in January 2023, bringing nearly 30 years of experience in the human resources industry, with a focus in the retail sector. Most recently, Mrs. Tennessen was senior vice president of human resources at Five Below, where Mrs. Tennessen was instrumental in developing a human resources strategy to support corporate growth and 25,000 employees in corporate, stores, and supply chain functions in 41 states across the U.S.

Charles Nelles joined as chief technology officer in January 2022, bringing more than 20 years of technology experience in the healthcare and financial services industries. Prior to working at The Joint, Mr. Nelles held the role of vice president of technology for American Express Global Business Travel. Prior to that, he served as vice president of technical operations support and cloud enablement for Western Union.