UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material under Rule 14a-12 |

THE JOINT CORP.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

16767 N. Perimeter Drive, Suite 240

Scottsdale, AZ 85260

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 31, 2019

Dear Stockholder:

You are cordially invited to attend our 2019 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Friday, May 31, 2019 at 10:00 a.m. Mountain Standard Time at 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260.

At the Annual Meeting, you will be asked to consider and vote on the following items:

| · | the election to the Board of the 7 nominees for director named in this proxy statement, |

| · | ratification of the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for the year ending December 31, 2019, and |

| · | any other matter that properly comes before the meeting. |

Only stockholders of record at the close of business on the record date of April 18, 2019 are entitled to vote at the Annual Meeting.

If you need directions to the meeting, please call Investor Relations at (480) 245-5960.

For the convenience of our stockholders of record who do not plan to attend the Annual Meeting in person but who want their shares voted, we have enclosed a proxy card. If you do not plan to attend the Annual Meeting, please complete and return the proxy card in the envelope provided, or go to www.cstproxy.com/thejoint/2019 and follow the instructions. If you return your proxy card and later decide to attend the Annual Meeting in person, or if for any other reason you want to revoke your proxy, you may do so at any time before your proxy is voted. If you hold your shares through a broker, bank, or other nominee, please see the instructions in the General Information section on how to vote your shares, either by written instruction or in person at the meeting.

By Order of the Board of Directors,

Craig Colmar

Secretary

Scottsdale, Arizona

April 26, 2019

This summary highlights information contained elsewhere in this proxy statement. It does not contain all information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Stockholders

| • | Time and Date: | Friday, May 31, 2019 at 10:00 a.m. Mountain Standard Time |

| • | Place: | 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260 |

| • | Record Date: | April 18, 2019 |

| • | Voting: | Stockholders as of the record date are entitled to vote. |

Items of Business and Voting Recommendations

| Board | |||||

| Agenda Item | Recommendation | Page | |||

| 1. | Election of 7 directors | FOR EACH NOMINEE | 4 | ||

| 2. | Ratification of the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for 2018 | FOR | 25 | ||

Board Nominees

The following table provides summary information about the nominees for director. Each director is elected by a majority of votes cast.

| Nominee | Age | Director Since | Principal Occupation | Committees | ||||||||

| Matthew E. Rubel | 61 | 2017 | Lead Director; current director of TreeHouse Foods, Inc.; Chairman, Mid Ocean Partners Private Equity Consumer Group; former President and CEO of Varsity Brands, Inc.; former Chairman and CEO of Collective Brands, Inc.; and Cole Haan, Inc.; former Senior Advisor with Roark Capital Group and TPG Capital, L.P.

| • Compensation • Nominating and Governance | ||||||||

| James H. Amos, Jr. | 73 | 2015 | Current Chairman of the advisory board of APFI, Procter and Gamble’s franchising initiatives; former Chairman and Chief Executive Officer of Mail Boxes, Etc.; former Chairman of the International Franchise Association

| • Nominating and Governance (Chair) | ||||||||

| Ronald V. DaVella | 61 | 2014 | Former audit partner with Deloitte & Touche LLP; Executive Vice President of Finance, The Alkaline Water Company; former Chief Financial Officer of Nanoflex Power Corporation and Amazing Lash Studio LLC

| • Audit (Chair) • Nominating and Governance | ||||||||

| Suzanne M. Decker | 57 | 2017 | Chief Human Resources Officer for Aspen Dental Management, Inc.

| • Compensation | ||||||||

| Peter D. Holt | 60 | 2016 | President and Chief Executive Officer, The Joint Corp.

| |||||||||

| Abe Hong | 47 | 2018 | Executive Vice President & Chief Information Officer at Discount Tire Company

| • Audit | ||||||||

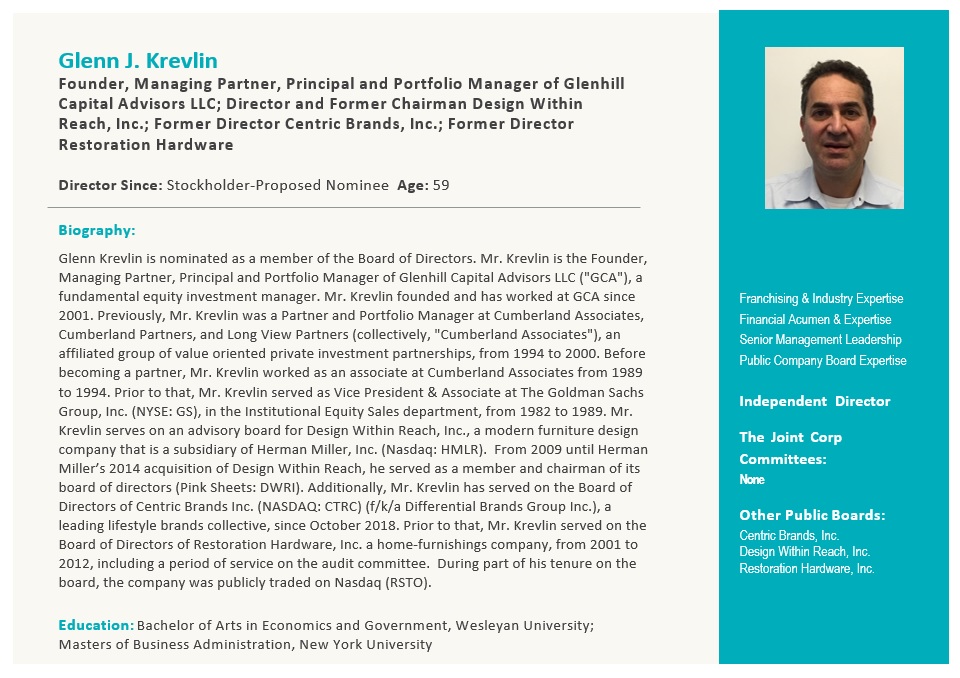

| Glenn J. Krevlin | 59 | — | Former Founder, Managing Partner, Principal and Portfolio Manager of Glenhill Capital Advisors LLC

| |||||||||

1

16767 N. Perimeter Drive, Suite 240

Scottsdale, AZ 85260

2019 Annual Meeting of Stockholders To Be Held on May 31, 2019

We are a “smaller reporting company” under Item 10 of Regulation S-K promulgated under the Securities Exchange Act of 1934 and have elected to comply with certain of the requirements applicable to smaller reporting companies in connection with this proxy statement.

We are also an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of these provisions until we are no longer an emerging growth company. We will remain an emerging growth company until the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering or, if earlier, (a) the last day of the first fiscal year in which we have total annual gross revenue of at least $1.07 billion, (b) the date that we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our prior second fiscal quarter, or (c) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of some but not all of these reduced disclosure requirements.

In this proxy statement, “we,” “us,” “our” and the “Company” all refer to The Joint Corp.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our common stock outstanding as of April 18, 2019 by:

| · | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our common stock; |

| · | each of our directors; |

| · | each of our named executive officers; and |

| · | all of our directors and executive officers as a group. |

The percentage ownership information shown in the table is based upon 13,785,334 shares of common stock outstanding as of April 18, 2019.

Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

2

Except as otherwise noted below, the address for each person or entity listed in the table is c/o The Joint Corp., 16767 N. Perimeter Drive, Suite 240, Scottsdale, AZ, 85260.

| Number of Shares Beneficially Owned | Percentage of Shares | ||||||

| Named Executive Officers. Other Executive Officers, Directors and Director Nominees | |||||||

| Matthew E. Rubel(1) | 21,952 | * | |||||

| James H. Amos, Jr.(2) | 77,847 | * | |||||

| Ronald V. DaVella(3) | 50,797 | * | |||||

| Suzanne M. Decker(4) | 15,452 | * | |||||

| Peter D. Holt(5) | 180,968 | 1.3% | |||||

| Abe Hong(6) | 5,502 | * | |||||

| Richard A. Kerley(7) | 40,787 | * | |||||

| Glenn J. Krevlin(8) | 403,722 | 2.9% | |||||

| Jake Singleton(9) | 43,396 | * | |||||

| Named executive officers and directors as a group (9 persons) | 840,423 | 6.1% | |||||

| 5% Stockholders | |||||||

| Bandera Partners LLC(10) | 1,304,301 | 9.5% | |||||

| Nantahala Capital Management, LLC(11) | 1,128,693 | 8.2% |

* Less than 1% of our shares

| (1) | The shares shown as beneficially owned by Mr. Rubel include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019. | |

| (2) | The shares shown as beneficially owned by Mr. Amos include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019 and shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days after April 18, 2019. | |

| (3) | The shares shown as beneficially owned by Mr. DaVella include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019 and shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days after April 18, 2019. | |

| (4) | The shares shown as beneficially owned by Ms. Decker include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019. | |

| (5) | The shares shown as beneficially owned by Mr. Holt include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019 and shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days after April 18, 2019. | |

| (6) | The shares shown as beneficially owned by Mr. Hong include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019. | |

| (7) | The shares shown as beneficially owned by Mr. Kerley include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019 and shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days after April 18, 2019. | |

| (8) | Based on Schedule 14N filed by The Austin Trust dated January 1, 2006 (reporting person) on December 27, 2018, nonimating Glenn J. Krevlin (Nominee) for election to the Board of Directors. The Nominee may be deemed to beneficially own a total of 403,772 shares of Common Stock, including 398,434 shares of Common Stock owned directly by Glenn Krevlin Revocable Trust, of which the Nominee is the grantor, and 5,338 shares of Common Stock owned directly by Krevlin 2005 Gift Trust, of which the Nominee is the grantor. The shares of Common Stock owned by Glenn Krevlin Revocable Trust and Krevlin 2005 Gift Trust were acquired through in-kind distributions from affiliates of GCM in connection with the winding down of such funds. | |

| (9) | The shares shown as beneficially owned by Mr. Singleton include shares of restricted stock that have vested or will vest within 60 days after April 18, 2019 and shares of stock issuable under stock options that are exercisable or will become exercisable within 60 days after April 18, 2019. | |

| (10) | Based on Schedule 13G filed by Bandera Partners LLC on May 22, 2018. | |

| (11) | Based on Schedule 13G filed by Nantahala Capital Management, LLC on February 14, 2019. |

3

Item 1

Our Board of Directors is currently composed of 7 directors. With the exception of Peter D. Holt, our President and Chief Executive Officer, all of our directors are outside directors (i.e., directors who are neither officers nor employees of ours).

Our common stock is listed on The NASDAQ Capital Market, and accordingly, we have used the definition of “independence” of the NASDAQ Stock Market to determine whether our directors are deemed to be independent. Based on that definition, we have determined that, with the exception of Peter D. Holt, our President and Chief Executive Officer, all of our directors (and director nominees) are independent.

Each director elected at the Annual Meeting will hold office until our annual meeting of stockholders in 2020 or until his or her successor is elected and qualified.

The election of directors is uncontested.

Voting in Uncontested Director Election

Under our bylaws, each director shall be elected by the vote of a majority of the votes cast in an uncontested election (an election in which the number of nominees for election is the same as the number of directors to be elected). In other words, the nominee must receive more “for” votes than “against” votes, with abstentions and broker non-votes not having any effect on the voting.

If a nominee for election as a director is an incumbent director and the nominee is not re-elected, Delaware law provides that the director continues to serve as a “holdover” director until his successor is elected and qualified or until he or she resigns. Under our bylaws, if an incumbent director is not re-elected, the director shall tender his or her resignation to the board of directors. The Nominating and Governance Committee shall make a recommendation to the Board whether to accept or reject the director’s resignation or whether other action should be taken. The Board shall act on the Committee's recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of certification of the election results. The director who tendered his or her resignation shall not participate in the Committee’s deliberations (if he or she is a member of the Committee) or in the Board’s decision.

The following table provides information about the nominees for election as directors.

Nominee | Position with the Company | Age | |||||

| Matthew E. Rubel | Lead Director | 61 | |||||

| James H. Amos, Jr. | Director | 73 | |||||

| Ronald V. DaVella | Director | 61 | |||||

| Suzanne M. Decker | Director | 57 | |||||

| Peter D. Holt | President, Chief Executive Officer and Director | 60 | |||||

| Abe Hong | Director | 47 | |||||

| Glenn J. Krevlin* | Stockholder-Proposed Director Nominee | 59 | |||||

*Mr. Krevlin was nominated by stockholder The Austin Trust dated January 1, 2006, in accordance with the “proxy access” provisions in our bylaws relating to nominations of directors by stockholders. Steven P. Colmar is the trustee of The Austin Trust Dated January 1, 2006.

4

5

6

7

8

9

Richard A. Kerley has served as a director since September 2015. He served as Lead Director from March 2016 to March 2017. Mr. Kerley served as chief financial officer and member of the board of directors of Peter Piper, Inc., a privately-held pizza and entertainment restaurant chain. He joined Peter Piper in 2008 after serving as chief financial officer of Fender Musical Instruments Corporation, a privately-held manufacturer and wholesaler of musical instruments and equipment. Prior to that, Mr. Kerley spent over 30 years at Deloitte & Touche, most recently as audit partner on both public and private companies. He is currently a member of the board of directors of The Providence Service Corporation (NASDAQ: PRSC), a Connecticut-based holding company whose subsidiaries provide high-quality, technology enabled healthcare and workforce development services in the United States and abroad, and Cavco Industries, Inc. (CVCO), a Delaware corporation, that designs and produces factory-built homes primarily distributed through a network of independent and Company-owned retailers, planned community operators and residential developers. He received a BBA in Accounting from, Marshall University.

We believe that our 7 director nominees possess the experience, qualifications and skills that warrant their election as directors. Our directors have in common, among other qualities, a breadth of business experience, seasoned judgment and an insistence on looking beyond the next quarter or the next year in directing and supporting our management. From their service in management, on the boards of other public and private companies, and in counseling other companies and their directors, our directors also bring to us the insights that they gain from the operating policies, governance structures and growth dynamics of these other companies.

The Board regularly reviews the skills, experience, and background that it believes are desirable to be represented on the Board.

10

|

|

11

The Board of Directors recommends that stockholders vote “FOR” each of the 7 nominees to the Board.

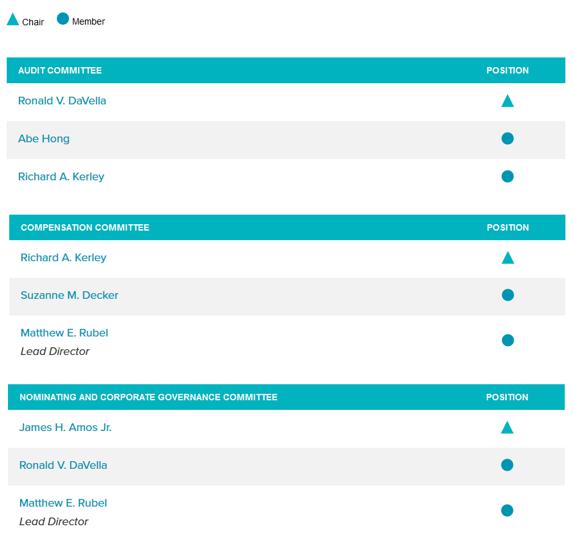

Our Board of Directors has standing Compensation, Audit, and Nominating and Governance Committees. All of the members of each committee are outside directors who are independent under the applicable listing standards of the NASDAQ Capital Market.

The Compensation Committee is responsible for determining the cash compensation and equity compensation of our executive officers. The Compensation Committee is responsible for, among other things: reviewing the respective salaries of our executive officers in light of our goals and objectives relevant to each officer; determining appropriate cash bonuses, if any, for our executive officers; and granting stock options and other awards under our stock option plan to our executive officers and other employees and determining the terms, conditions, restrictions and limitations of the options and awards granted.

The Audit Committee oversees our accounting and financial reporting processes and the integrity of our financial statements. The Audit Committee’s responsibilities also include oversight of our internal accounting and financial controls, the qualifications and independence of our independent accountants, and our compliance with legal and regulatory requirements. In addition, the Audit Committee is responsible for reviewing, setting policy regarding and evaluating the effectiveness of our processes for assessing significant risk exposures and the measures that management has taken to minimize such risks. In carrying out these responsibilities, the Audit Committee is charged with, among other things: appointing, replacing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; discussing with our independent registered public accounting firm their independence from management; reviewing with our independent registered public accounting firm the scope and results of their audit; approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; discussing with management and our independent registered public accounting firm the interim and annual consolidated financial statements that we file with the SEC; reviewing periodically with our counsel and/or principal regulatory compliance officer any legal and regulatory matters that may have a material adverse effect on our financial statements, operations, compliance policies and programs; reviewing and approving procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; reviewing and approving related person transactions; annually reviewing the Audit Committee charter and the Audit Committee’s performance; and handling such other matters that are specifically delegated to the Audit Committee by our Board of Directors from time to time.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the Board of Directors concerning corporate governance matters and the structure, composition and function of the Board of Directors and its committees.

The Nominating and Governance Committee is also responsible for developing and recommending to the Board of Directors criteria for identifying and evaluating candidates for directorships and making recommendations to the full Board regarding candidates for election or reelection to the Board of Directors at each annual stockholders’ meeting.

The Nominating and Governance Committee endeavors to select nominees that possess certain basic personal and professional qualities that are necessary in order to properly discharge their fiduciary duties to stockholders, provide effective oversight of management, and monitor adherence to principles of sound corporate governance. With limited exceptions, the Committee believes that all persons nominated to serve as director should possess certain minimum qualifications consisting of:

| · | integrity and ethical character and an appreciation of these qualities in others, |

| · | an absence of conflicts of interest, |

| · | the ability to provide fair and equal representation of all stockholders, |

| · | demonstrated achievement in one more fields of business, professional, governmental, communal, scientific or educational endeavor, |

| · | sound judgment, resulting from management or policy-making experience, that demonstrates an ability to function effectively in an oversight role, |

12

| · | business understanding, with a general appreciation of major issues facing public companies of a size and operational scope similar to ours, |

| · | available time to devote to the business of the Board of Directors and its committees, |

| · | competencies and skills which are complementary to those of the existing members of the Board, which skills should include experience in one or more of the following areas: franchising, small box retail, company governance, management, financial matters, marketing and branding, real estate, technology, strategy, risk management and legal affairs, and |

| · | professional background, experience, expertise, perspective, age, gender, ethnicity and country of citizenship which will promote diversity on the Board of Directors. |

We are of the view that the continuing service of qualified incumbents promotes stability and continuity in the board room, contributing to the Board of Director's ability to work as a collective body, while giving us the benefit of the familiarity and insight into our affairs that our directors have accumulated during their tenure. Accordingly, the process of the Nominating and Governance Committee for identifying nominees reflects the practice of re-nominating incumbent directors who continue to satisfy the Committee's criteria for membership on the Board and whom the Committee believes continue to make important contributions to the Board. Consistent with this policy, in considering candidates for election at annual meetings of stockholders, the Committee will first determine the incumbent directors whose terms expire at the upcoming meeting and who wish to continue their service on the Board. The Committee will then evaluate their qualifications and performance, and if the Committee determines that an incumbent director continues to be qualified and has satisfactorily performed his or her duties during the preceding term, the Committee will propose the incumbent director for re-election, absent special circumstances.

The Committee will identify and evaluate new candidates for election to the Board in order to fill vacancies on the Board when there is no qualified and available incumbent. In evaluating new candidates, the Committee will consider whether the candidates meet the minimum qualifications discussed above. These qualifications include consideration as to whether and how the candidate would contribute to the Board’s diversity, defined broadly to include gender and ethnicity as well as background and experience. The Committee will solicit recommendations for nominees from persons that the Committee believes are likely to be familiar with qualified candidates, which may include current Board members and management, and the Committee has the authority to retain a professional search firm for assistance if appropriate. The Committee will consider candidates proposed by stockholders and will evaluate any candidate proposed by a stockholder using the same criteria used to evaluate any other candidate, except that the Committee may consider, as one of the factors in its evaluation of stockholder-recommended nominees, the size and duration of the interest of the recommending stockholder in our equity. The Committee may also consider the extent to which the recommending stockholder intends to continue holding its interest, including, in the case of nominees recommended for election at an annual meeting, whether it intends to continue holding its interest at least through the time of such annual meeting.

Procedures for Submitting Stockholder-Recommended Nominees. Any stockholder who wants to propose a candidate should submit a written recommendation to the Nominating and Governance Committee indicating the candidate’s qualifications and other relevant biographical information and providing preliminary confirmation that the candidate would be willing to serve as a director. Any such recommendation should be addressed to the Board of Directors, The Joint Corp., 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260.

In addition to recommending director candidates to the Nominating and Governance Committee, stockholders may also, pursuant to procedures established in our bylaws, directly nominate one or more director candidates to stand for election at an annual meeting of stockholders. A stockholder wishing to make such a nomination must deliver written notice of the nomination to the secretary of the Company not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting of stockholders. If, however, the date of the annual meeting is more than 30 days before or after the first anniversary, the stockholder’s notice must be received no later than the close of business on the 90th day, and no earlier than the 120th day, prior to the annual meeting.

Stockholders may also submit director nominees to the Board to be included in our annual proxy statement, known as “proxy access.” Stockholders who intend to submit director nominees for inclusion in our proxy materials for the 2020 Annual Meeting of Stockholders must comply with the requirements of proxy access as set forth in our bylaws. The stockholder or group of stockholders who wish to submit director nominees pursuant to proxy access must deliver the required materials to the Company not less than 120 days nor more than 150 days prior to the anniversary of the date that the Company first mailed its proxy materials for the annual meeting of the previous year.

13

The charters of the Audit, Compensation, and Nominating and Governance Committees are available on our website www.thejoint.com.

Committee Members and Meetings

The following tables provide information about the membership of the committees of the Board of Directors during 2018:

| (1) | The Board of Directors has determined that both Mr. DaVella, the Chairman of the Audit Committee, and Mr. Kerley, a member of the Audit Committee, are audit committee financial experts as described in the applicable rules of the U.S. Securities and Exchange Commission. |

Our Board of Directors held seven meetings in person or by teleconference during 2018 and acted without a formal meeting on a number of occasions by the unanimous written consent of the directors. The Audit Committee held seven meetings during the year, the Compensation Committee held four meetings during the year, and the Nominating and Governance Committee held seven meetings during the year.

All of our directors attended in person or participated by teleconference in all of the meetings of the Board of Directors during 2018, with the exception of two directors missing one meeting. All of the members of the Audit, Compensation, and Nominating and Governance Committees attended in person or participated by teleconference in all of the meetings of those committees during the year.

We encourage our directors to attend the Annual Meeting of stockholders.

14

The following table sets forth compensation paid to our non-employee directors for the year ended December 31, 2018:

| Name | Fees Earned or Paid in Cash | Stock(1)(2) Awards | Option Awards | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | |||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||

| Matthew E. Rubel | 50,000 | 40,000 | — | — | — | — | 90,000 | |||||||

| James H. Amos, Jr. | 45,000 | 40,000 | — | — | — | — | 85,000 | |||||||

| Ronald V. DaVella | 48,750 | 40,000 | — | — | — | — | 88,750 | |||||||

| Suzanne M. Decker | 40,000 | 40,000 | — | — | — | — | 80,000 | |||||||

| Richard A. Kerley | 46,250 | 40,000 | — | — | — | — | 86,250 | |||||||

| Abe Hong | 14,361 | 40,000 | — | — | — | — | 54,361 | |||||||

| Bret Sanders | 28,631 | — | — | — | — | — | 28,631 |

| (1) | The amounts in this column represent the aggregate grant date fair value of stock awards granted to the director in the applicable fiscal year, computed in accordance with FASB ASC Topic 718. For a discussion of the assumptions used in reaching this valuation, see “Restricted Stock” in Note 10 to our audited financial statements included in our annual report on Form 10-K for the year ended December 31, 2018. |

| (2) | The aggregate number of stock awards outstanding at December 31, 2018 held by each non-employee director was as follows: Mr. Rubel – 5,502; Mr. Amos – 5,502; Mr. DaVella – 5,502; Ms. Decker – 5,502; Mr. Hong – 5,502; and Mr. Kerley – 5,502. |

Each director who is not also one of our employees, upon election or re-election to the board of directors, will receive a fee of $40,000.00 per year. Each non-employee director, upon his or her election or re-election as a director, will also receive that number of restricted shares equal to $40,000.00, divided by the closing price of our stock on the election date. This restricted stock will be granted under The Joint Corp. 2014 Stock Plan and will vest on the first anniversary of the grant. In addition to the compensation described above, each committee chair will receive an annual committee chair stipend in the following amount:

| · | Audit Committee chair: $7,500.00 |

| · | Compensation Committee chair: $5,000.00 |

| · | Nomination and Governance Committee chair: $5,000.00 |

Our lead director receives an annual stipend in the amount of $10,000.00. The board of directors formed a special information technology committee to oversee the selection, development and implementation of our new IT platform. Members of this information technology committee will receive a stipend in the amount of $5,000.00. All fees payable to directors shall be payable quarterly.

All of our non-employee directors will be reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of the board of directors or the committees thereof and for other expenses reasonably incurred in their capacity as directors.

15

Executive Sessions of the Board

Our Board of Directors excuses Mr. Holt, our President and Chief Executive Officer, as well as any of our other executive officers who may be present by invitation, from a portion of each meeting of the Board in order to allow the Board to review Mr. Holt’s performance as President and Chief Executive Officer and to enable each director to raise any matter of interest or concern without the presence of management.

Our directors annually review the performance of the Board of Directors and its committees and the performance of their fellow directors. Typically, this is done through the completion by the directors of confidential evaluation forms, the results of which are provided to Mr. Amos as the Chairman of the Nominating and Governance Committee. At a subsequent meeting of the Board, Mr. Amos leads a discussion with the full Board of any issues and suggestions for improvement identified in these evaluation forms.

The Board of Directors has adopted a written policy requiring certain transactions with related parties to be approved in advance by the Audit Committee. A related party includes any director or executive officer, or an immediate family member of any director or executive officer, for purposes of this policy. The transactions subject to review include any transaction, arrangement or relationship (or any series of similar transactions, arrangements and relationships) in which (i) we or one of our subsidiaries will be a participant, (ii) the aggregate amount involved exceeds $100,000 and (iii) a related party will have a direct or indirect interest. The Audit Committee will consider the benefits to us of the proposed transaction, the potential effect of the proposed transaction on the director’s independence (if the related party is a director), and the terms of the proposed transaction and whether those terms are comparable to the terms available to an unrelated third party or to employees generally in reviewing the proposed transaction with related parties.

Johnson and Colmar, a law firm, provided general legal representation in 2018 and in 2017. For these legal services, we were billed $257,564 in 2018 and $220,749 in 2017. Craig Colmar was one of our directors from March 2010 until June 2017 and is a partner in Johnson and Colmar and shared in the profits of Johnson and Colmar generated by these legal fees to the extent of his interest in Johnson and Colmar.

Stockholders who would like to communicate with the Board may do so by writing to the Board of Directors, The Joint Corp. 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260. Our Investor Relations department will process all communications received. Communications relating to matters within the scope of the Board’s responsibilities will be forwarded to the Lead Director and at his direction to the other directors, and communications relating to ordinary day-to-day business matters that are not within the scope of the Board’s responsibilities will be forwarded to the appropriate officer or executive. Communications addressed to a particular committee of the Board will be forwarded to the chair of that committee and at his direction to the other members of the committee.

Our Audit Committee is responsible for overseeing our risk management process. The Audit Committee focuses on our general risk management strategy and the most significant risks facing us and ensures that appropriate risk mitigation strategies are implemented by management. The Audit Committee reports any significant issues to the Board of Directors as part of the Board’s general oversight responsibility.

Our management is responsible for day-to-day risk management. This oversight includes identifying, evaluating and addressing potential risks that may exist at the enterprise, strategic, financial, operational, compliance and reporting levels.

16

Leadership Structure of the Board of Directors

Chairman of the Board

We presently do not have a director serving in the office of Chairman of the Board. While our bylaws and corporate governance guidelines do not require the positions of Chairman and Chief Executive Officer to be separate, our Board of Directors believes that having separate positions is the appropriate leadership structure for us and demonstrates our commitment to good corporate governance. In the event we do elect a Chairman, we intend to adhere to the principle that the position of Chairman of the Board should be separate from the position of Chief Executive Officer.

Lead Director

In August 2017, our Board appointed Matthew E. Rubel as our Lead Director. The Lead Director is responsible for coordinating the scheduling and agenda of Board meetings and the preparation and distribution of agenda materials. The Lead Director presides at Board meetings and oversees the scope, quality and timeliness of the flow of information from our management to the Board and serves as an independent point of contact for stockholders wishing to communicate with the Board.

We have established stock ownership guidelines for certain of our senior officers (currently, our President and Chief Executive Officer and Chief Financial Officer) and our directors to more closely align their interests with those of our stockholders. Under these guidelines, they are required to own shares of Company stock having a value equal to or greater than the following targets within 5 years of becoming subject to the targets:

| Category | Stock Ownership Target | |

| CEO | 3 times annual total cash compensation | |

| Other §16 Officers | 2 times annual total cash compensation | |

| Board of Directors | 2 times annual cash retainer | |

17

Under the Audit Committee’s charter, the Audit Committee of the Board of Directors assists the Board in fulfilling its oversight responsibilities relating to the integrity of the Company’s financial statements, the qualifications and experience of the Company’s independent registered public accounting firm, the performance of the Company’s internal audit function and independent registered public accounting firm, and the Company’s compliance with applicable legal and regulatory requirements. The Committee’s charter is available on the Company’s website, www.the joint.com. The members of the Committee who served during 2018 were Ronald V. DaVella (Chairman), Richard A. Kerley and Abe Hong, all of whom are independent under the applicable listing standards of the NASDAQ Capital Market.

In regard to our role, we note that it is the responsibility of the Company’s management to prepare financial statements in accordance with accounting principles generally accepted in the United States and that it is the responsibility of the Company’s independent registered public accounting firm to audit those financial statements. The Committee’s responsibility is one of oversight, and we do not provide expert or other special assurance regarding the Company’s financial statements or the quality of the audits performed by the Company’s independent public accountants.

In carrying out our oversight responsibility, we review and discuss with both management and Plante & Moran, PLLC, the Company’s independent registered public accounting firm, all quarterly and annual financial statements prior to their issuance. We reviewed and discussed with both management and Plante & Moran, PLLC the quarterly and annual financial statements for the fiscal year ended December 31, 2018. Our reviews and discussions with Plante & Moran, PLLC included executive sessions without the presence of the Company’s management. They also included discussions of the matters required to be discussed pursuant to Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended (AICPA, Professional Standards, vol. 1 AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, including the quality of the Company’s accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the Company’s financial statements. We also discussed with Plante & Moran, PLLC matters relating to their independence, including a review of their audit and non-audit fees and the letter and written disclosures that the Committee received from Plante & Moran, PLLC pursuant to Rule 3526 of the Public Company Accounting Oversight Board, Communications with Audit Committees Concerning Independence.

In addition, we continued to monitor the scope and adequacy of the Company’s internal controls, including the review of programs and initiatives to strengthen the effectiveness of the Company’s internal controls and steps taken to implement recommended improvements.

On the basis of these reviews and discussions, we recommended to the Board of Directors that the Board approve the inclusion of the Company’s audited financial statements in the Company’s annual report on Form 10-K for the year ended December 31, 2018 for filing with the U.S. Securities and Exchange Commission.

Audit Committee

Ronald V. DaVella, Chairman

Richard A. Kerley

Abe Hong

18

The following table provides information about our executive officers.

Executive Officer | Position with the Company | Age | |||

| Peter D. Holt | President and Chief Executive Officer | 60 | |||

| Jake Singleton | Chief Financial Officer | 37 |

Peter D. Holt, our President and Chief Executive Officer, is listed as a nominee for director. Please see “Nominees for Director” on page 8.

19

The following table shows the total compensation paid or accrued during our fiscal years ended December 31, 2018 and 2017 to our President and Chief Executive Officer, Chief Financial Officer and former Chief Financial Officer:

| Name | Year | Salary | Bonus | Stock Awards | Option(4)

Awards | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other(5) Compensation | Total | |||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||

| Peter D. Holt(1) | 2018 | 409,084 | 214,997 | 24,998 | 75,622 | — | — | — | 724,701 | |||||||||

| President and Chief Executive Officer | 2017 | 375,000 | — | — | 70,317 | — | — | — | 445,317 | |||||||||

| Jake Singleton(2) | 2018 | 183,013 | 46,157 | 86,254 | 116,343 | — | — | 3,109 | 431,767 | |||||||||

| Chief Financial Officer | 2017 | 169,615 | — | — | 42,345 | — | — | — | 211,960 | |||||||||

| John P. Meloun(3) | 2018 | 158,043 | — | — | — | — | — | — | 158,043 | |||||||||

| Former Chief Financial Officer | 2017 | 188,750 | — | — | 52,935 | — | — | — | 241,685 |

| (1) | Mr. Holt has served as our President and Chief Executive Officer since January 2017. Prior to January 2017, Mr. Holt served as Chief Executive Officer from August 2016, acting Chief Executive Officer from June 2016, and Chief Operating Officer from April 2016. |

| (2) | Mr. Singleton has served as our Chief Financial Officer since November 2018. Prior to November 2016, Mr. Singleton served as the Company’s Corporate Controller. |

| (3) | Mr. Meloun served as our Chief Financial Officer from November 2016 to July 2018. Prior to November 2016, Mr. Meloun served as the Company’s Director of Financial Planning and Reporting. |

| (4) | The amounts in this column represent the share-based compensation expense recorded in our audited financial statements for the years ended December 31, 2018 and 2017, based on the option’s grant-date fair value. For a discussion of the assumptions used in reaching this valuation, see “Stock-Based Compensation” in Note 1 to our audited financial statements included in our annual report on Form 10-K for the year ended December 31, 2018. |

| (5) | The amounts in this column represent company contributions (including matching contributions), whether or not vested, on a nondiscriminatory basis to a defined contribution plan (e.g., 401(k) plan) |

20

Employment Agreements and Change in Control Arrangements

Current Executive Officers

Mr. Holt’s amended and restated employment agreement ended on December 31, 2018. On December 4, 2018, Mr. Holt entered into a new employment letter agreement with the Company for a term of one year, effective on January 1, 2019 and automatically renewable for successive one-year terms unless terminated by either party. He will receive a base annual salary of $410,000 and a yearly bonus under the Company’s Executive Short-Term Incentive Plan (the “Executive STIP”), as described below. Mr. Holt also will continue to be eligible to participate in the Company’s incentive stock plan and any other future long-term incentive plans, subject to the terms and eligibility requirements of any such plans and at the discretion of the Company’s board of directors or compensation committee in making awards under such plans. Under his employment letter agreement, Mr. Holt will be awarded stock options under the stock plan to purchase a number of shares of the Company’s common stock equal to 60% of his base salary, which will vest in four equal annual installments on each of the first four anniversaries of the grant date. The options will be granted at the same time that other employees receive their 2019 long-term incentive grants.

Upon the Company’s termination of Mr. Holt’s employment without “cause” (as defined in the employment letter), subject to the Company and Mr. Holt entering into a separation agreement containing customary provisions, the Company will continue to pay Mr. Holt his then current base salary and earned bonus payments for a period of twelve months after the date of termination and any bonus payments he may have earned prior to the date of termination. The Company shall have no obligation to pay Mr. Holt any salary amounts accruing in periods following the date of his termination.

In addition, the Company will provide Mr. Holt with the right to continue to participate in the Company’s group health insurance program under COBRA continuation coverage during the statutory continuation period following his termination date, the first six months of which will be paid by the Company, and the balance by Mr. Holt.

On November 6, 2018, Mr. Singleton entered in an employment letter agreement with the Company for a term of one year, automatically renewable for successive one-year terms unless terminated by either party. Under the agreement, he will receive a base annual salary of $200,000 and a yearly bonus under the Company’s Executive STIP as described below. Mr. Singleton also will continue to be eligible to participate in the Company’s incentive stock plan and any other future long-term incentive plans, subject to the terms and eligibility requirements of any such plans and at the discretion of the Company’s board of directors or compensation committee in making awards under such plans. In addition, the Board of Directors approved a severance award of six months for termination other than for cause or disability. In connection with his employment, Mr. Singleton has received stock options and a restricted stock award as outlined in the table below.

Upon the Company’s termination of Mr. Singleton’s employment without “cause” (as defined in the employment letter), subject to the Company and Mr. Singleton entering into a separation agreement containing customary provisions, the Company will continue to pay Mr. Singleton his then current base salary and earned bonus payments for a period of six months after the date of termination. The Company will have no obligation to pay Mr. Singleton any salary amounts accruing in periods following the date of his termination.

21

Both Mr. Holt and Mr. Singleton participate in the Company’s annual Executive STIP. Participants in the Executive STIP will receive payment only if the Company achieves its target EBITDA for the year in question, which will be established by the Board of Directors. The Executive STIP bonus pool will be combined with the bonus pool for the Non-Executive Short-Term Incentive Plan (the “Combined Pool”). The Compensation Committee will establish the maximum amount that may be allocated to the Combined Pool, and the amount by which the actual EBITDA exceeds the target EBITDA will be allocated to the Combined Pool up to the established maximum. The amount allocated to the Combined Pool will then be paid to the participants in both the Executive STIP and the Non-Executive Short-Term Incentive Plan on a pro rata basis based on their respective eligibility, and in each case, up to their maximum targeted STIP award. Mr. Holt’s targeted STIP award will not exceed 50% of his base salary. Mr. Singleton’s award will not exceed 40% of his base salary.

Notwithstanding the foregoing, in the event that the actual EBITDA for the year in question after the funding of the maximum amount allocated to the Combined Pool as described in the previous paragraph (“Revised EBITDA”) exceeds the target EBITDA, the maximum targeted STIP award for Mr. Holt would increase to 62.5% of his base salary and the maximum targeted STIP award for Mr. Singleton would increase to 50% of his base salary. In that event, 25% of each dollar by which Revised EBITDA exceeds the budgeted EBITDA will be added to the Combined Pool and allocated to the participants in both the Executive STIP and the Non-Executive Short-Term Incentive Plan on a pro rata basis based on their respective eligibility, and in each case, up to their maximum targeted STIP award, as adjusted.

Former Executive Officer

John Meloun resigned his position as our Chief Financial Officer effective July 20, 2018. Mr. Meloun had served in that position since November 2016, with an annual salary of $215,000 effective January 1, 2018. In connection with his employment, Mr. Meloun received stock options as disclosed in the table above.

22

Outstanding Equity Awards at 2018 Year-End

The following table provides a summary of equity awards outstanding at December 31, 2018, for each of our named executive officers.

| Option Awards(1) | Stock Awards(2) | |||||||||||||||||

Name | Number of securities underlying unexercised options exercisable | Number of securities underlying unexercised options unexercisable |

Option exercise price |

Option expiration date |

Number of shares of stock that have not vested |

Market value of shares that have not vested | ||||||||||||

| Peter D. Holt | 47,500 | 47,500 | (3) | $3.14 | 5/3/2026 | — | — | |||||||||||

| 25,000 | 25,000 | (4) | $2.23 | 7/11/2026 | — | — | ||||||||||||

| 20,003 | — | (5) | $3.88 | 5/9/2027 | — | — | ||||||||||||

| 3,750 | 11,250 | (6) | $5.51 | 11/10/2027 | — | — | ||||||||||||

| — | 21,614 | (7) | $8.25 | 8/7/2028 | — | — | ||||||||||||

| — | — | — | — | 3,030 | (8) | $25,210 | ||||||||||||

| Jake Singleton | — | — | — | — | 1,000 | (9) | $8,320 | |||||||||||

| 5,000 | 5,000 | (10) | $4.10 | 3/14/2026 | — | — | ||||||||||||

| 10,000 | 10,000 | (11) | $2.24 | 8/9/2026 | — | — | ||||||||||||

| 10,473 | — | (12) | $3.88 | 5/9/2027 | — | — | ||||||||||||

| 2,500 | 7,500 | (13) | $5.51 | 11/10/2027 | — | — | ||||||||||||

| — | 3,242 | (14) | $8.25 | 8/7/2028 | — | — | ||||||||||||

| — | 35,000 | (15) | $7.10 | 11/6/2028 | — | — | ||||||||||||

| — | — | — | — | 455 | (16) | $3,786 | ||||||||||||

| — | — | — | — | 10,000 | (17) | $83,200 | ||||||||||||

| (1) | Outstanding stock options at December 31, 2018 become exercisable in accordance with the vesting schedule below. Each option award expires on the ten-year anniversary of the grant date. |

| (2) | Restricted stock awards at December 31, 2018 become exercisable in accordance with the vesting schedule below. Market value at December 31, 2018 was $8.32 per share. |

| (3) | Options to acquire 95,000 shares were granted on May 3, 2016, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (4) | Options to acquire 50,000 shares were granted on July 11, 2016, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (5) | Options to acquire 20,003 shares were granted on May 9, 2017 and vested in full on March 31, 2018. |

| (6) | Options to acquire 15,000 shares were granted on November 10, 2017, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (7) | Options to acquire 21,614 shares were granted on August 7, 2018, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (8) | Restricted stock awards were granted on August 7, 2018, and one-quarter (25%) of the restricted shares vest on each of the first four anniversaries of the grant date. |

| (9) | Restricted stock awards were granted on July 15, 2015, and one-quarter (25%) of the restricted shares vest on each of the first four anniversaries of the grant date. |

| (10) | Options to acquire 10,000 shares were granted on March 14, 2016, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (11) | Options to acquire 20,000 shares were granted on August 9, 2016, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (12) | Options to acquire 10,473 shares were granted on May 9, 2017 and vested in full on March 31, 2018. |

| (13) | Options to acquire 10,000 shares were granted on November 10, 2017, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (14) | Options to acquire 3,242 shares were granted on August 7, 2018, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (15) | Options to acquire 35,000 shares were granted on November 6, 2018, and one-quarter (25%) of the option shares vest on each of the first four anniversaries of the grant date. |

| (16) | Restricted stock awards were granted on August 7, 2018, and one-quarter (25%) of the restricted shares vest on each of the first four anniversaries of the grant date. |

| (17) | Restricted stock awards were granted on August 7, 2018, and one-quarter (25%) of the restricted shares vest on each of the first four anniversaries of the grant date. |

23

Equity Compensation Plan Information

We maintain two equity compensation plans, the 2014 Incentive Stock Plan (the “2014 Plan”) and the 2012 Stock Plan (the “2012 Plan”). The 2014 Plan replaced the 2012 Plan, but the 2012 plan remains in effect for the administration of awards made prior to its replacement by the 2014 Plan. The following table summarizes information about our equity compensation plans as of December 31, 2018. All outstanding awards relate to our common stock.

| Plan Category | Number of securities to be issued upon exercise of options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | 607,913 | |||||||||||

| Stock options | 986,691 | $ | 4.72 | |||||||||

| Restricted stock | 51,134 | n/a | ||||||||||

| Total | 1,037,825 | 607,913 | ||||||||||

24

Item 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTING FIRM

We have appointed Plante & Moran, PLLC as our independent registered public accounting firm for the fiscal year ending December 31, 2019. Plante & Moran, PLLC has served as our independent registered public accounting firm since October 2018. Plante & Moran, PLLC served as our independent registered public accounting firm for the year ended December 31, 2018. They or their predecessor EKS&H LLLP have served as our public accounting firm since 2013, when they were retained in preparation for our initial public offering. Representatives of Plante & Moran, PLLC are expected to be present at the Annual Meeting to respond to appropriate questions and will have the opportunity to make a statement if they desire to do so.

The aggregate fees billed by Plante & Moran, PLLC for professional services rendered in connection with the audit of our annual financial statements during the fiscal years ended December 31, 2018 and 2017 were $197,497 and $208,726, respectively.

The aggregate fees billed by Plante & Moran, PLLC for professional services rendered in connection with the audit of our 401(k) plan and other audit-related services during the fiscal year ended December 31, 2018 was $11,000. There were no fees billed by Plante & Moran, PLLC for audit-related services during the fiscal year ended December 31, 2017.

There were no fees billed by Plante & Moran, PLLC for tax compliance, tax advice and tax planning services provided to us during the fiscal years ended December 31, 2018 and 2017, respectively.

Plante & Moran, PLLC did not provide any services to us during the fiscal year ended December 31, 2018 and 2017, respectively, other than for professional services rendered in connection with the audit of our annual financial statements.

In accordance with policies adopted by the Audit Committee of our Board of Directors, all audit and non-audit related services to be performed for us by our independent public accountants must be approved in advance by the Committee.

Ratification of the appointment of Plante & Moran, PLLC as our independent registered public accounting firm will require the affirmative vote of holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting. If our stockholders do not ratify the appointment of Plante & Moran, PLLC, our Board of Directors may reconsider their appointment.

The Board of Directors recommends that stockholders vote “FOR” ratification of the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for the fiscal year ending December 31, 2019.

25

Why did I receive this proxy statement and other materials?

The Board of Directors of The Joint Corp. is soliciting proxies to vote shares of our stock at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Friday, May 31, 2019 at 10:00 a.m. Mountain Standard Time at our executive offices located at 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260.

This proxy statement and our annual report to stockholders (which includes a copy of our Annual Report on Form 10-K for the year ended December 31, 2018), were first made available to stockholders on April 26, 2019. Although both are made available together, our annual report to stockholders is not part of this proxy statement.

What will stockholders vote on at the Annual Meeting?

Stockholders will vote on the following matters at the Annual Meeting:

| · | the election to the Board of the 7 nominees for director named in this proxy statement (Item 1), |

| · | ratification of the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for 2019 (Item 2), and |

| · | any other matter that properly comes before the meeting. |

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

| · | FOR each of the 7 nominees for election to the Board (Item 1), and |

| · | FOR ratification of the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for 2018 (Item 2). |

Who may vote at the Annual Meeting?

Only stockholders of record as of the close of business on April 18, 2019 are entitled to vote at the Annual Meeting.

Each outstanding share of common stock as of the record date is entitled to one vote on all matters that come before the meeting. There is no cumulative voting.

As of the record date of April 18, 2019, there were 13,785,334 shares of our common stock outstanding.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

If your shares are registered directly in your name with our stock registrar and transfer agent, Continental Stock Transfer and Trust Company, you are considered the stockholder of record for those shares and have the right to vote those shares directly. You may vote in person at the Annual Meeting or by proxy.

If your shares are held in an account at a brokerage firm, bank or other nominee (for convenient reference, a “broker”), you are considered the beneficial owner of those shares, which are said to be held in “street name,” and the broker is considered the stockholder of record for voting purposes. As the beneficial owner, you cannot vote the shares in your account directly, but you have the right to instruct the broker how to vote them.

As a beneficial owner, you are invited to attend the Annual Meeting, but because you are not a stockholder of record, you may not vote your shares at the Annual Meeting unless you obtain a valid proxy from your broker.

26

If I am a stockholder of record, how do I vote?

You may vote by proxy by completing and signing the proxy card included in the materials and returning it in the postage-paid envelope provided (which must be received before those voting facilities are closed at 7:00 p.m. Eastern Daylight Time on May 30, 2019) or you may vote in person at the Annual Meeting.

If I am a beneficial owner of shares held in street name, how do I instruct my broker how to vote?

If you are a beneficial owner of our stock, you may instruct your broker how to vote by following the instructions in the notice provided to you by your broker.

What happens if I am a stockholder of record and sign and return the proxy card but do not make any voting choices?

The proxy holders (the persons named as proxies) will vote your shares in accordance with the Board’s voting recommendations for Items 1 and 2. See “What are the Board’s voting recommendations?” above.

We do not expect that any other matters will properly come before the Annual Meeting. If, however, any other matters do come before the meeting, the proxy holders will vote your shares in accordance with their judgment.

What happens if I am a beneficial owner of shares held in street name and do not give voting instructions to my broker?

Under the stock exchange and other rules governing brokers who are voting shares held in street name, brokers have authority to vote those shares at their discretion on routine matters but may not vote those shares on non-routine matters.

A “broker non-vote” occurs when your broker returns a proxy card for your shares held in street name but does not vote on a particular matter because (i) the broker has not received voting instructions from you and (ii) the broker does not have authority to vote on the matter without instructions because the matter is of a non-routine nature.

Which items to be voted on at the Annual Meeting are “routine” and which are “non-routine”?

The ratification of the appointment of our independent registered public accounting firm (Item 2) is considered a routine matter under the relevant rules. The election to the Board of the seven nominees for director (Item 1) is considered a non- routine matter.

What is the quorum required for the Annual Meeting?

Holders of a majority of our outstanding shares entitled to vote at the Annual Meeting who are present in person or represented by proxy will constitute a quorum to conduct business at the meeting.

If you are a stockholder of record and vote your shares by proxy, your shares will be counted for purposes of determining whether a quorum is present even if your voting choice is to abstain. Similarly, if you are a beneficial owner of shares held in street name and do not give voting instructions to your broker, your shares will be counted for purposes of determining whether a quorum is present if your broker votes your shares on any routine matter.

What are my choices in voting on the matters to be voted on at the Annual Meeting?

On Item 1 (the election of directors), you may vote “For” or “Against” each individual nominee or “Abstain” from voting on the nominee’s election.

On Item 2 (ratification of the appointment of our independent registered public accounting firm), you may vote “For” or “Against” the proposal or “Abstain” from voting on the proposal.

27

What are the voting requirements to approve the matters to be voted on at the Annual Meeting?

| · | Item 1 (election of directors): Each nominee for election as a director must receive more “For” votes than “Against” votes in order to be elected as a director. Abstentions and broker non-votes will not have any effect on the voting. |

| · | Item 2 (ratification of the appointment of our independent registered public accounting firm): This proposal requires for approval the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote. Abstentions will have the same effect as a vote “Against.” Brokers will have discretionary authority to vote Item 2, and therefore there will not be any broker non-votes on this matter. |

Can I change my vote after I have voted?

If you are a stockholder of record, you may change your vote by returning a new, properly completed proxy card bearing a later date than the date of your original proxy card (before those voting facilities are closed at 7:00 p.m. Eastern Daylight Time on May 30, 2019).

In addition, you may revoke your proxy by attending the Annual Meeting in person and requesting to vote.

Attendance at the meeting in person will not, by itself, revoke your proxy. You may also revoke your proxy any time before the final vote at the Annual Meeting by filing a signed notice of revocation with the Secretary of the Company at 16767 N. Perimeter Drive, Suite 240, Scottsdale, AZ 85260.

If you are a beneficial owner of shares held in street name, you may submit new voting instructions to your broker as indicated in the notice provided to you by your broker.

How can I find out the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by the inspector of elections and reported in a current report on Form 8-K, which we will file with the SEC within four business days following the Annual Meeting.

Who is paying for the cost of this proxy solicitation?

We will bear the cost of this proxy solicitation. Some of our officers and employees may solicit proxies by personal conversations, telephone, regular mail or email, but they will not receive any additional compensation for doing so. We will reimburse brokers and others for their reasonable charges and expenses in forwarding our proxy materials to stockholders who are beneficial owners of shares of our stock.

How can I attend the Annual Meeting?

We encourage our stockholders to attend the Annual Meeting. The Annual Meeting will be held on Friday, May 31, 2019 at 10:00 a.m. Mountain Standard Time, at 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260. If you need directions to the meeting, please call Investor Relations at (480) 245-5960.

28

We will provide a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2018 without charge to each stockholder as of the record date who sends a written request to Investor Relations, The Joint Corp., 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260. Copies of this proxy statement and our Form 10-K as filed with the Securities and Exchange Commission are available in pdf format on our website, www.thejoint.com. Copies of this proxy statement and our Form 10-K also may be accessed directly from the SEC’s website, www.sec.gov.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

Brokers with account holders who are The Joint Corp. stockholders may be “householding” our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please notify your broker and direct your written request to The Joint Corp., Attention: Investor Relations, 16767 N. Perimeter Drive, Suite 240, Scottsdale, AZ, 85260, and one will be promptly provided. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.

As of the date of this proxy statement, management is unaware of any matter for action by stockholders at the meeting other than those described in the accompanying notice. The enclosed proxy, however, will confer discretionary authority with respect to any other matter that may properly come before the annual meeting, or any adjournment thereof. It is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment on any such matter.

29

STOCKHOLDER PROPOSALS AND NOMINATIONS FOR THE 2020 ANNUAL MEETING

Any stockholder who wishes to present a proposal for consideration at our 2020 Annual Meeting of Stockholders, and to have the proposal included in our proxy statement for the meeting, must submit the proposal to us on or before December 28, 2019. Stockholder proposals for inclusion in our proxy statement must comply with the rules of the Securities and Exchange Commission in order to be included.

In accordance with our bylaws, any stockholder who wishes to present a proposal from the floor for consideration at our 2020 Annual Meeting of Stockholders, without inclusion of such matters in our proxy materials, must submit proper notice to us no earlier than February 1, 2020 and no later than the close of business on March 2, 2020.

Stockholders who intend to submit director nominees for inclusion in our proxy materials for the 2020 Annual Meeting of Stockholders must comply with the requirements of proxy access as set forth in our bylaws. The stockholder or group of stockholders who wishes to submit director nominees pursuant to proxy access must deliver the proper notice to the Secretary of the Company no earlier than November 28, 2019 and no later than December 28, 2019.

Stockholder proposals and notice of proxy access nominations should be sent to Secretary, The Joint Corp., 16767 N. Perimeter Drive, Suite 240, Scottsdale, Arizona 85260. A copy of our bylaws is available at https://www.sec.gov/Archives/edgar/data/1612630/000117184318005943/exh_3ii1.htm or may be obtained upon request directed to the Secretary at the foregoing address.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires our directors and executive officers and persons beneficially owning more than 10% of our outstanding common stock to file periodic reports of stock ownership and stock transactions with the Securities and Exchange Commission. On the basis of a review of copies of these reports, we believe that all filing requirements for 2018 were satisfied in a timely manner.

30

31

32